This report is a prediction of the performance of Manhattan and Miami markets in Q2 2024.

We produce these reports quarterly and look at emerging trends across all buying segments in various locations.

These aren’t guesses by any stretch. They’re precise forecasts based on a thorough analysis of various data sources — current buying behavior, segment-specific pace cross-referenced analysis, historical sales patterns, upcoming flight schedules, customer footfall, expected weather conditions, and current events.

Use this to empower your sales, marketing, and revenue teams to make informed decisions.

If you find this information useful, consider LodgIQ’s commercial strategy platform. It’s designed to unite your revenue, sales, and marketing teams around the same data, facilitating informed decision-making. Unlike other platforms, ours not only presents data but also offers practical recommendations aimed at maximizing both revenue and profit.

This report provides just a glimpse of the comprehensive insights available. Not in Manhattan or Miami? Reach out if you’d like to see a report on your market, or to learn more about the valuable information we have to offer.

Methodology

We looked at three metrics — occupancy, ADR, and RevPAR.

We looked at three classes of Manhattan hotels — three, four, and five-star hotels.

And three Miami markets — Downtown Miami, Greater Miami Beach, and South Beach.

Our data looks at five segments:

- Group Business like group tours, conventions, and non-negotiated corporate rates

- Promotional Discounts like advanced purchases and promotional packages

- Negotiated/Corporate Business

- RACK/BAR like best available and “off the rack” customer demand

- Wholesale Business like tour operators or consolidators

Key Takeaways

Manhattan:

- In the coming months of Q2 2024, we anticipate a surge in RevPAR across all hotel categories in the New York market.

- This is expected to be fueled mainly by rising occupancy rates, signifying success in filling more rooms compared to the preceding year.

- While ADR might vary a bit, their consistency will make sure that the increased occupancy translates directly into more revenue. This will ultimately boost the overall RevPAR, showing a significant surge.

- We predict YOY growth in both occupancy and RevPAR across all Manhattan hotel categories (Five-Star, Four-Star, and Three-Star).

- Five-Star hotels will aim for premium pricing and target specific segments to maintain high ADR and RevPAR.

- Negotiated/Corporate Business will play a pivotal role in RevPAR increase in Four-Star hotels.

- Promotional Discounts and Negotiated/Corporate Business will drive RevPAR growth in Three-Star hotels.

- Occupancy, ADR, and RevPAR will peak in May.

- Occupancy and RevPAR will grow significantly under group business segments.

- RevPAR is expected to grow across the Manhattan market, driven by increases in both occupancy and ADR. This growth will be particularly evident in Group Business, Bar/RACK, and Negotiated/Corporate segments.

Miami

- In Downtown Miami and Greater Miami Beach, both occupancy and ADR will be boosting RevPAR growth. Occupancy is expected to be the biggest driver of RevPAR increase.

- In South Beach, the significant increase in occupancy outweighs the decrease in ADR, leading to overall growth in RevPAR.

- Miami markets will see increases in both occupancy and RevPAR across the following segments:

- Downtown Miami in group business

- Greater Miami Beach in Negotiated/Corporate Business

- South Beach in Group Business

- Promotional Discount room occupancy will be on the rise in both Downtown Miami and Greater Miami Beach, indicating a potential market shift toward value-conscious consumers.

- Bar/RACK occupancy, on the other hand, is predicted to decrease in both Downtown Miami and Greater Miami Beach, suggesting a potential preference shift away from standard rates.

Manhattan

Q2 2024 Manhattan Market Total Occupancy

Expected occupancy for the Manhattan market in Q2 2024 (plus change compared to Q2 2023)

- April: 85.3% overall, a 4% increase

- May: 90.1% overall, a 9.7% increase

- June: 87.4% overall, a 5.2% increase

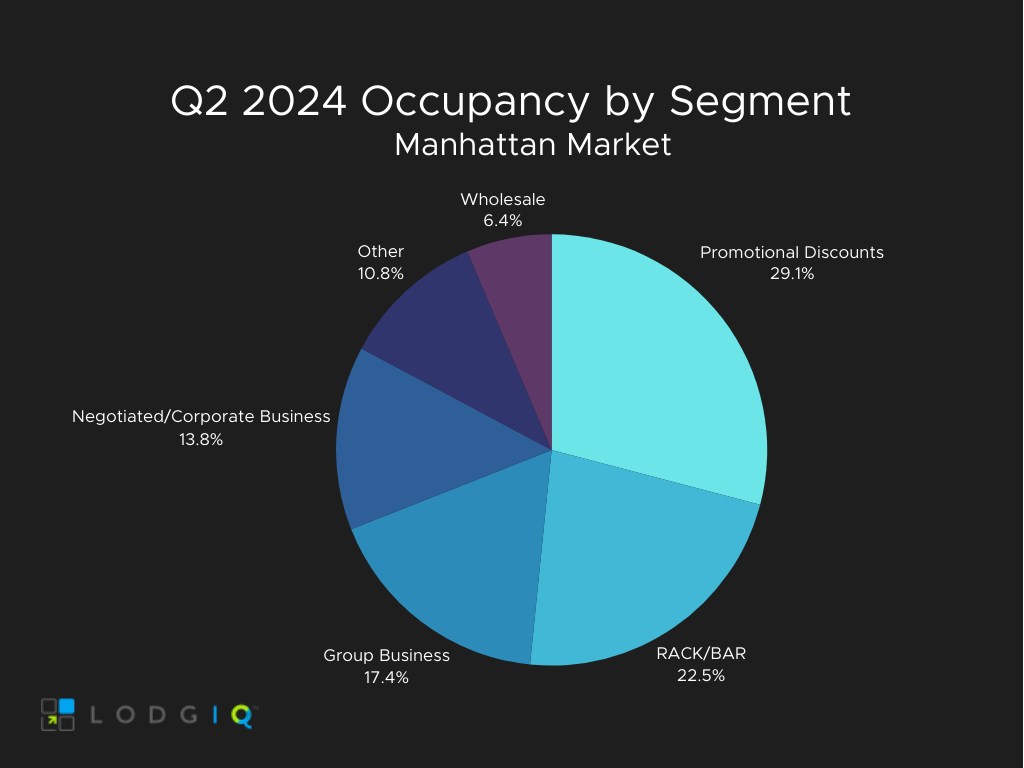

We predict the Group Business segment to occupy 17.4% of total occupied rooms, an 11.5% increase from Q2 2023. Promotional Discount and Bar/Rack are expected to make up the bulk of occupancy.

We predict 87.6% occupancy in Q2 2024, a 6.3% increase compared to last year. Most occupancy, 29.1%, is expected to come from Promotional Discounts, a 1.4% drop from Q2 2023.

Although they make up the second largest occupancy percentage, we predict a dip for Bar/Rack. This segment is expected to see a decrease of about 3.8% when compared to Q2 2023.

Q2 2024 Manhattan ADR

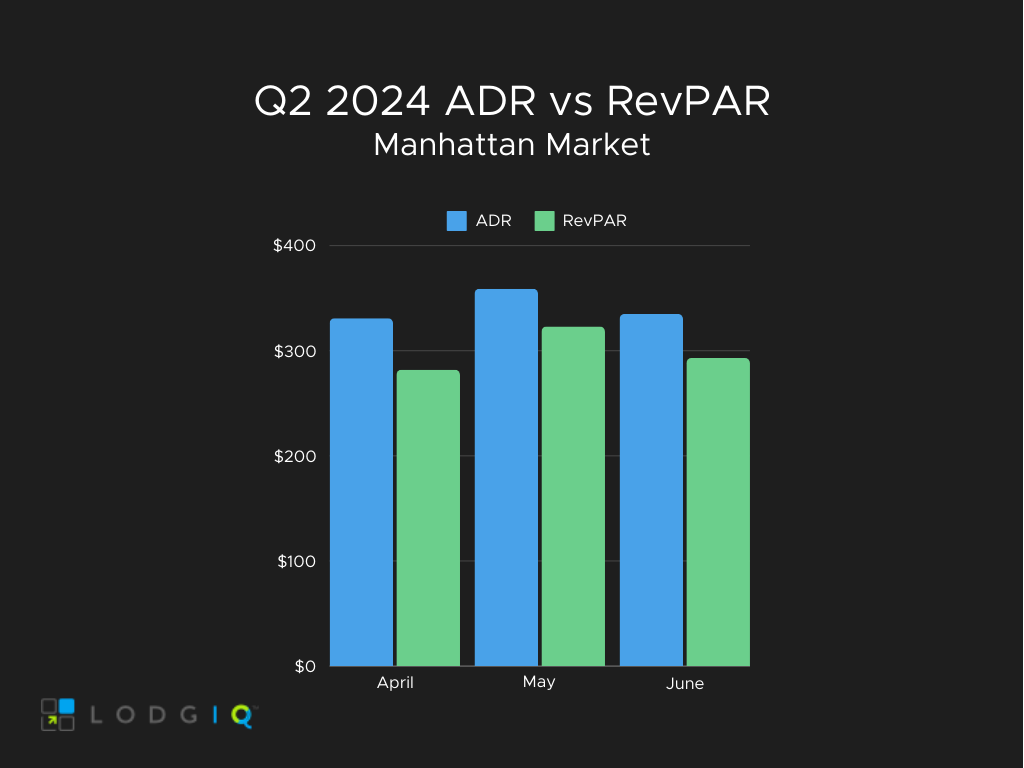

Expected ADR for the Manhattan market in Q2 2024 (plus change compared to Q2 2023)

- April: $331, a 0.6% decrease

- May: $359, a 1.1% increase

- June: $335, a 0.9% decrease

We predict the Q2 ADR for the entire Manhattan market to be $342, the same amount it was in Q2 2023.

Negotiated/Corporate Business is expected to have the highest ADR ($424), down 0.93% when compared to Q2 2023. Proportionately, Negotiated/Corporate Business will have the highest ADR by segment each month.

- April: $409

- May: $448

- June: $415

Q2 2024 Manhattan RevPAR

We predict RevPAR to be $300 in Q2 2024 in the Manhattan market, a 6.3% increase compared to Q2 2023.

Expected RevPAR for the Manhattan market in Q2 2024 (plus change compared to Q2 2023)

- April: $282, a 3.3% increase

- May: $323, a 10.6% increase

- June: $293, a 4.3% increase

Group Business is projected to have the biggest RevPAR changes of the segments, up 18.2% from 2023. This will account for 17.2% of overall RevPAR.

Promotional Discount will make up 27.2% of revenue, the same when compared to Q2 2023.

Both Negotiated/Corporate and Rack/BAR revenue per available room will be down 3.4% compared to Q2 2023.

Implications

- The increase in RevPAR will mainly stem from higher occupancy rates, indicating that hotels will successfully fill more rooms in Q2 2024 compared to the same period in 2023.

- With ADR expected to hold steady, it will ensure that the rise in occupancy directly boosts revenue without altering pricing strategies.

Manhattan Five-Star Hotel Q2 2024 Forecast

Q2 2024 Manhattan Five-Star Hotel Occupancy

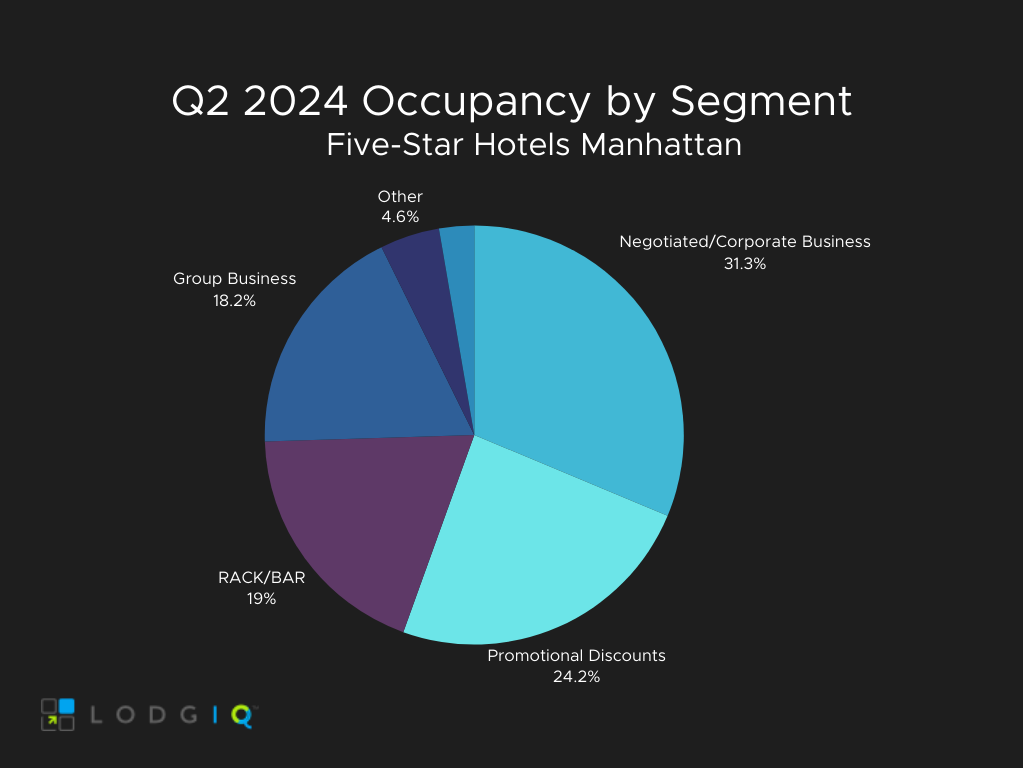

We anticipate Five-Star hotels to be at 76.3% average occupancy in Q2, a 9.3% increase over last year.

Negotiated/Corporate will make up the bulk of occupancy, at 31.3% of rooms, down 7.1% from 2023.

Rack/BAR is predicted to see the highest increase across all segments (up 21.8% from last year) and will account for 19% of occupied rooms.

Expected occupancy for five-star hotels in Q2 2024 (plus change compared to Q2 2023)

- April: 71.7%, a 3.6% increase

- May: 80.3%, a 15.2% increase

- June: 76.6%, an 8.7% increase

Q2 2024 Manhattan Five-Star Hotel ADR

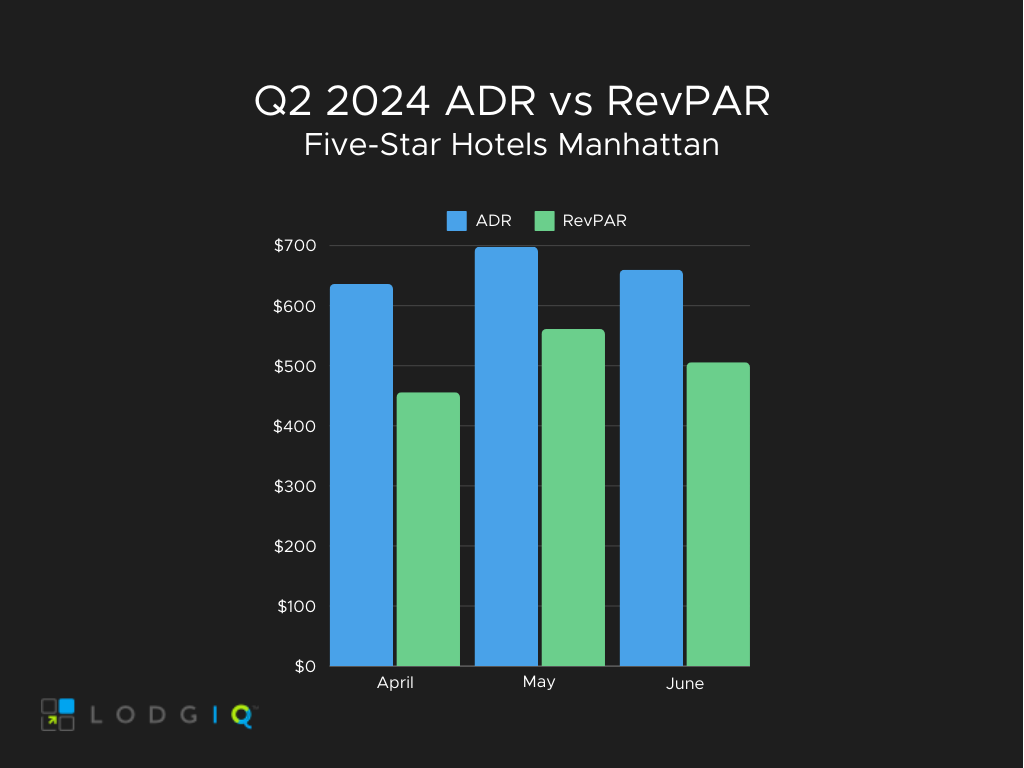

We expect five-star hotels to have an overall ADR of $665, a small decrease of 0.8% from Q2 2023.

Expected ADR for five-star hotels in Q2 2024 (plus change compared to Q2 2023)

- April: $636, a 4.2% decrease

- May: $698, a 0.3% increase

- June: $640, a 0.8% increase

The Rack/BAR segment will have the highest ADR each month.

- April: $776

- May: $944

- June: $809

And we expect Wholesalers/Tour business to have an ADR of $581, an increase of 22.1% compared to last year, the highest expected increase across segments. All other segments are expected to have small decreases when compared to Q2 2023.

Q2 2024 Manhattan Five-Star Hotel RevPAR

We expect five-star hotels to have a RevPAR of $508, an 8.4% expected growth compared to Q2 2023.

Both Group and Bar/RACK business RevPAR are expected to see big jumps, up 23.7% and 24.5%, respectively.

Expected RevPAR for five-star hotels in Q2 2024 (plus change compared to Q2 2023)

- April: $456, a 0.5% decrease

- May: $561, a 15.6% increase

- June: $506, a 9.5% increase

Implications

- The increase in RevPAR will be mainly due to rising occupancy rates.

- The stable ADR is expected to further support this revenue growth.

Manhattan Four-Star Hotel Q2 2024 Forecast

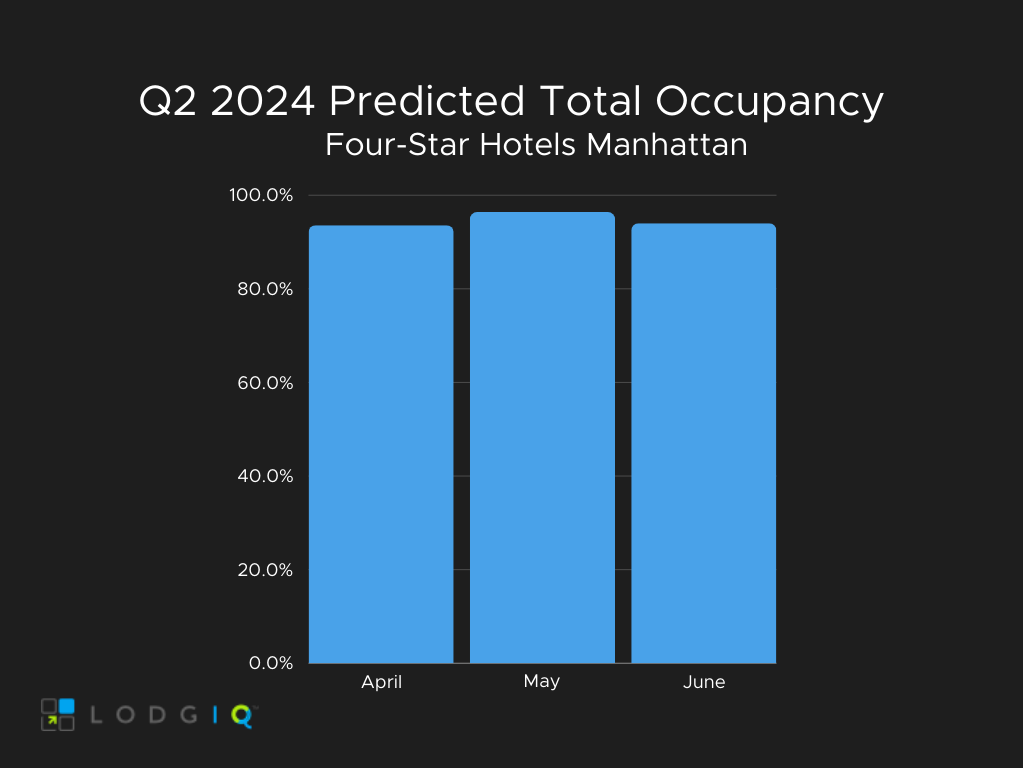

Q2 2024 Manhattan Four-Star Occupancy

We anticipate Four-Star hotels to be at 94.7% average occupancy in Q2, a 14% increase over last year.

Group and Negotiated/Corporate businesses will have the highest expected percentage increase across segments compared to Q2 2023, at 18.8% and 27%, respectively.

Expected occupancy for four-star hotels in Q2 2024 (plus change compared to Q2 2023)

- April: 93.6%, a 12.5% increase

- May: 96.4%, a 16.6% increase

- June: 94%, a 12.7% increase

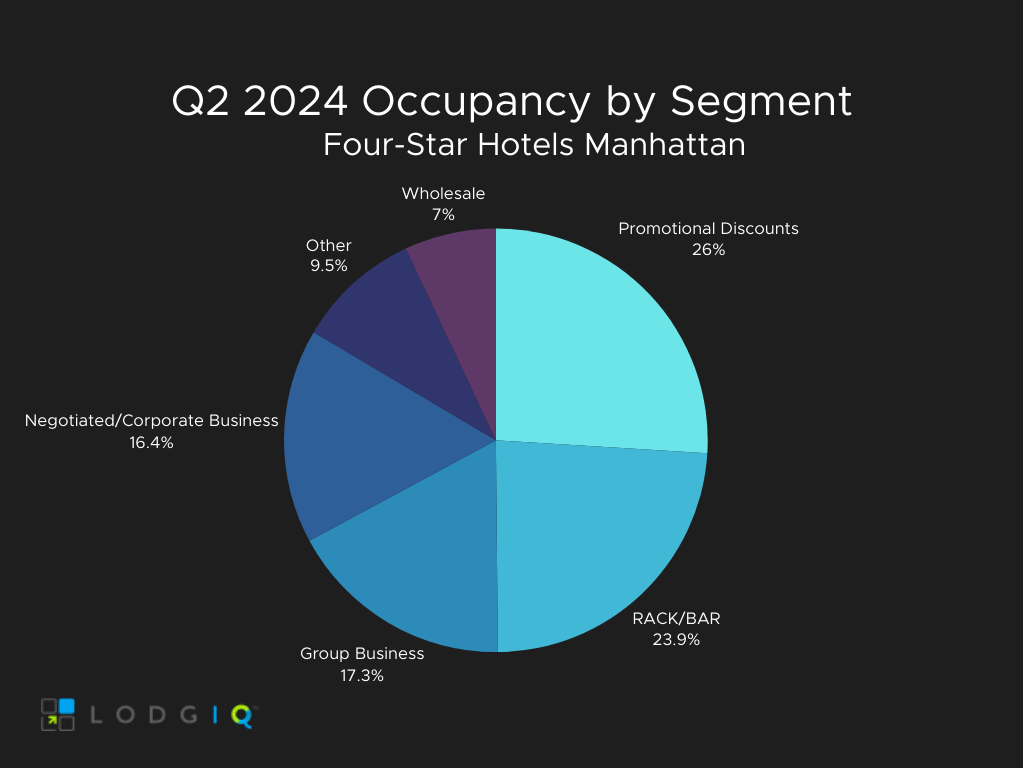

Rack/BAR and Promotional Discounts are predicted to occupy 23.9% and 26% of rooms, not changing from Q2 2023.

Negotiated/Corporate Business will see the highest occupancy increase, up 13.9% from Q2 2023.

Wholesale Business is expected to drop 14.6% and account for 7% of occupied rooms.

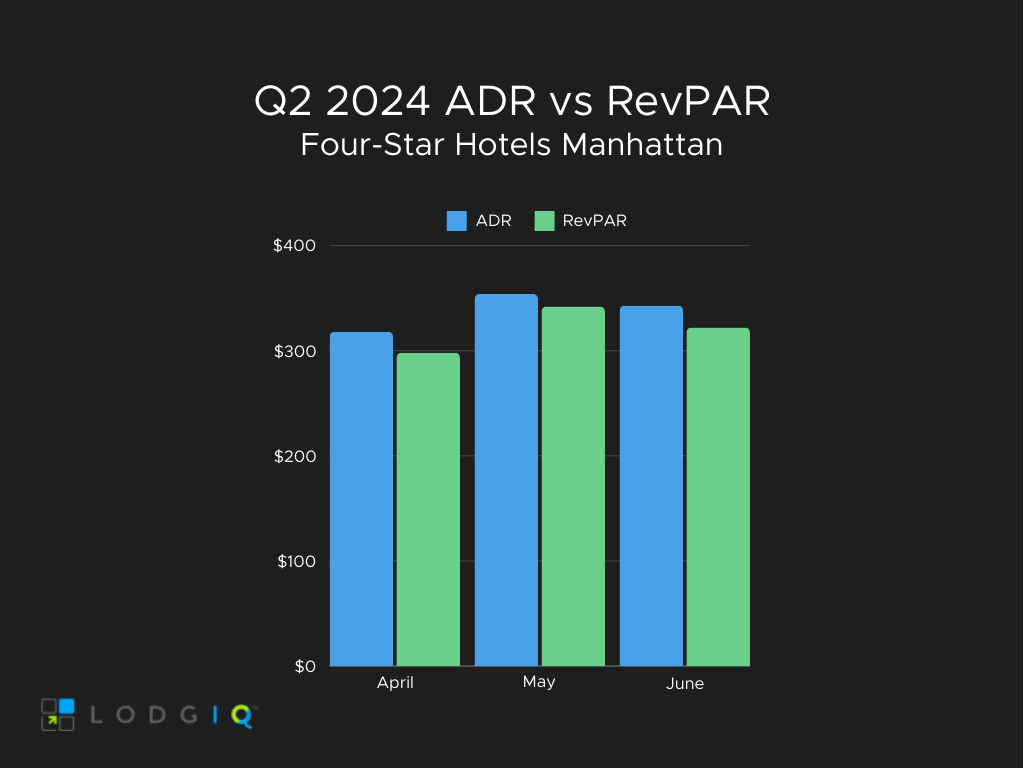

Q2 2024 Manhattan Four-Star Hotel ADR

We expect four-star hotels to have an overall ADR of $339, 10.9% growth compared to Q2 2023.

Expected ADR for four-star hotels in Q2 2024 (plus change compared to Q2 2023)

- April: $318, a 7.2% increase

- May: $354, an 11.7% increase

- June: $343, a 13.5% increase

The Rack/BAR segment will have the highest ADR each month.

- April: $373

- May: $417

- June: $412

Overall, Rack/BAR will see an increase of 15.9% when compared to Q2 2023.

Group Business will rise 11.4%, with a projected ADR of $343.

Q2 2024 Manhattan Four-Star Hotel RevPAR

We expect four-star hotels to have a RevPAR of $321, a significant 26.3% increase compared to Q2 2023.

Negotiated/Corporate Business will have the highest expected percentage change in RevPAR at 32.6%. They are expected to account for 17.8% of purchases, which is up 7.2% from 2023. Right behind them, Group Business is expected to be 17.5% of RevPAR, up 7.4% from last year.

Bar/Rack ($91) is expected to be the highest RevPAR, accounting for 30% of purchases. The highest RevPAR increase is anticipated to come from Negotiated/Corporate Business ($57), up 32.6% from Q2 2023.

Expected RevPAR for four-star hotels in Q2 2024 (plus change compared to Q2 2023)

- April: $298, a 20.6% increase

- May: $342, a 30.1% increase

- June: $322, a 27.9% increase

Implications

- We anticipate a notable growth in RevPAR for Four-Star hotels.

- This will be fueled by both higher occupancy rates and increased ADR, showing a successful balance between these factors to maximize revenue.

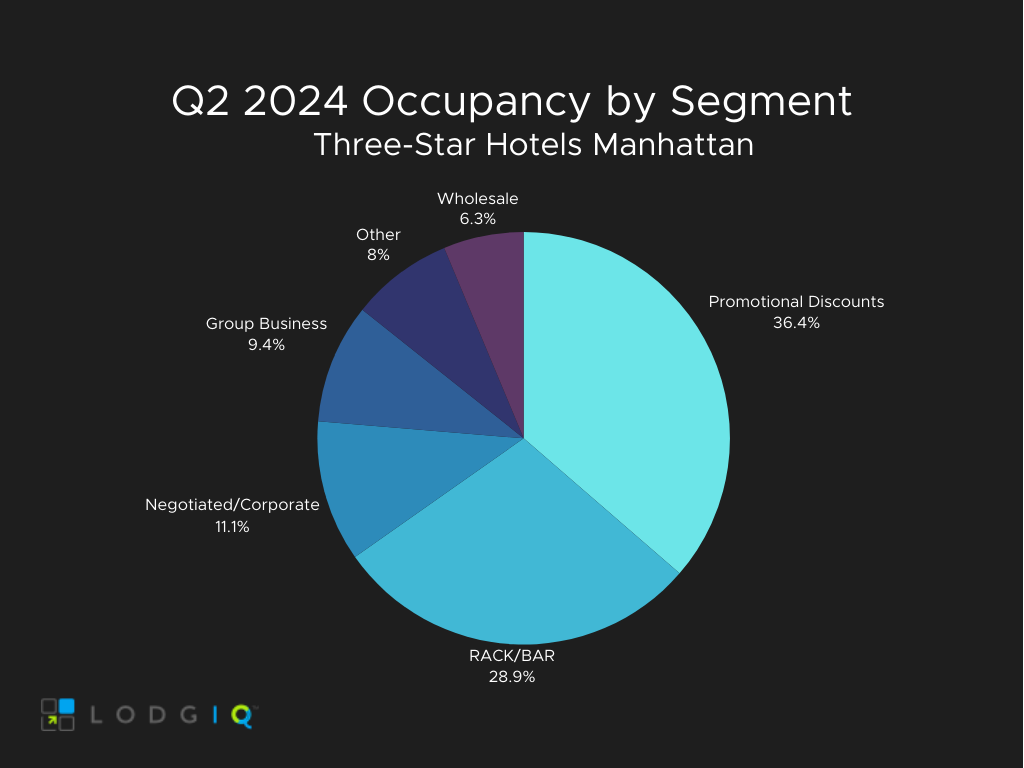

Manhattan Three-Star Hotel Q2 2024 Forecast

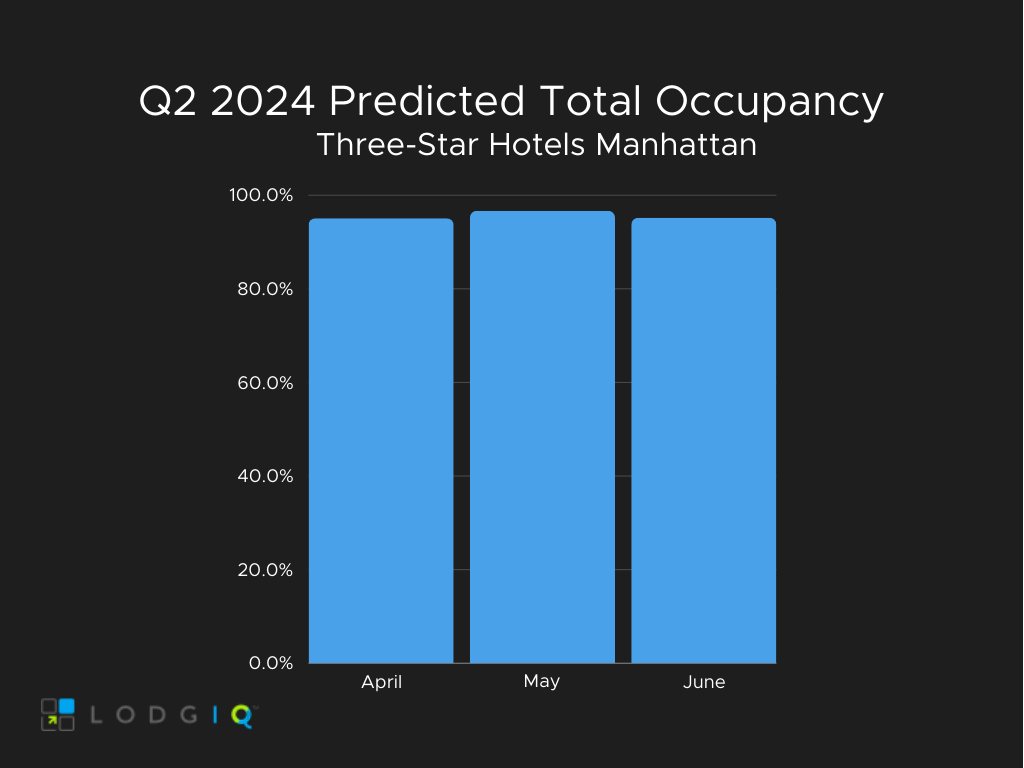

Q2 2024 Manhattan Three-Star Occupancy

We anticipate Three-Star hotels to be at 95.7% average occupancy in Q2, a 15.9% increase over last year.

Promotional Discounts are expected to be the highest percentage of occupancy (34.8%).

- 36.4% of occupied rooms are attributed to them, an unchanged amount when compared to Q2 2023.

Both Group business (9%) and Negotiated/Corporate rates (10.6%) will have increases of 38.5% and 41.3%, respectively. The highest of any segment.

Expected occupancy for three-star hotels in Q2 2024 (plus change compared to Q2 2023)

- April: 95.1%, a 20.7% increase

- May: 96.7%, a 15.3% increase

- June: 95.2%, an 11.5% increase

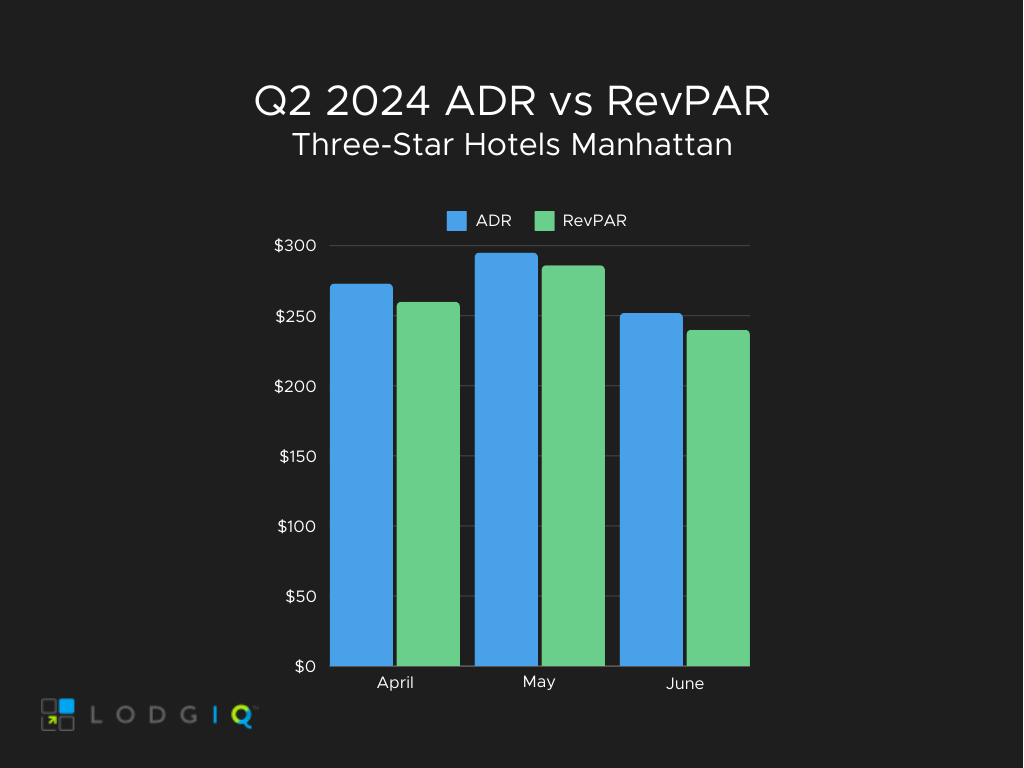

Q2 2024 Manhattan Three-Star Hotel ADR

We expect three-star hotels to have an overall ADR of $274, a 3.1% growth compared to Q2 2023.

Expected ADR for three-star hotels in Q2 2024 (plus change compared to Q2 2023)

- April: $273, a 4% increase

- May: $295, a 7.2% increase

- June: $252, a 2.3% decrease

Both Negotiated/Corporate Business and Bar/Rack will account for the highest projected ADR, with $314 and $318, respectively.

The Negotiated/Corporate segment is predicted to have the highest ADR in April ($304) and June ($313). Bar/RACK ADR will be the highest in May at $358.

Negotiated/Corporate Business are expected to rise 5.7% from 2023, the biggest growth of all segments. Bar/RACK business is right behind them at 5% expected growth.

Q2 2024 Manhattan Three-Star Hotel RevPAR

We expect three-star hotels to have a RevPAR of $262, a 19.3% expected growth compared to Q2 2023.

Both Group and Negotiated/Corporate Business will have the highest expected percentage changes in RevPAR at 43.8% and 50%. Group Business is expected to account for 8.7% (up 17.6% from 2023) of purchases, while Negotiated/Corporate Business is projected to make up 12.7% (up 28.3% from 2023).

Bar/RACK ($88) and Promotional Discounts ($86) account for highest RevPAR, accounting for 66.5% of revenue combined.

- Bar/RACK RevPAR is projected to increase by 20.5% in Q2 2024

- They are expected to account for 33.6% of purchases, up 3.1% from 2023

- Promotional Discounts are projected to increase 8.9% in 2024

- They are expected to account for 32.9% of purchases. This is 6.8% lower than 2023

Expected RevPAR for three-star hotels in Q2 2024 (plus change compared to Q2 2023)

- April: $260, a 25.5% increase

- May: $286, a 23.4% increase

- June: $240, an 8.8% increase

- Bar/RACK will be:

- 7.1% lower than April 2024

- 21% lower than May 2024

- Promotional Discounts will be:

- 9.3% lower than April 2024

- 17.9% lower than May 2024

- They are both about 58% higher than any other segment that month

- Bar/RACK will be:

Implications

- We predict that the growth in RevPAR for Three-Star hotels will mainly come from higher occupancy rates.

- Stable ADR will further support the revenue growth.

Miami

Below are three Miami markets. They are not broken up by hotel class.

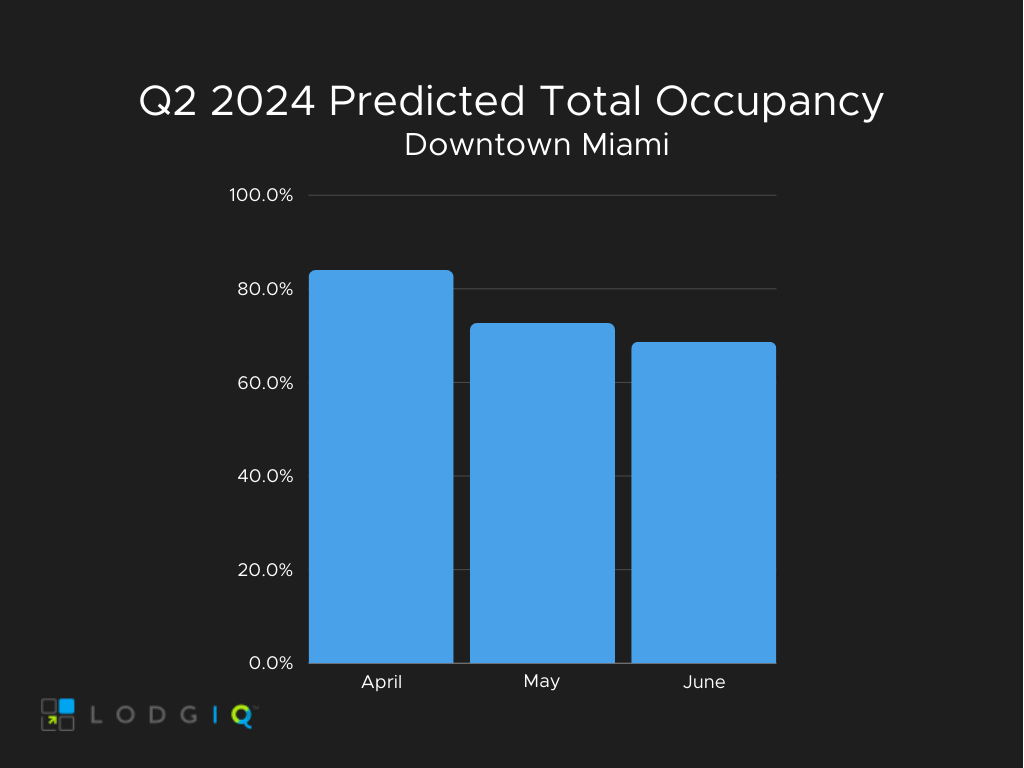

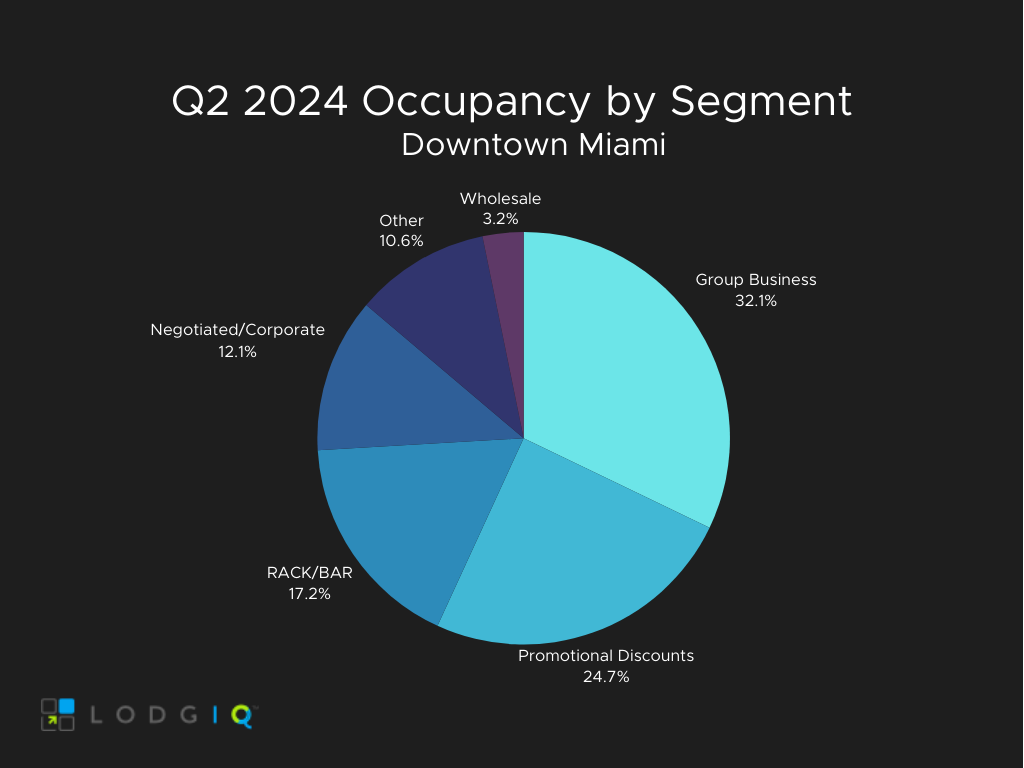

Downtown Miami Q2 2024 Forecast

Q2 2024 Downtown Miami Market Total Occupancy

Expected occupancy for the Downtown Miami market in Q2 2024 (plus change compared to Q2 2023)

- April: 84% overall, an 18.6% increase

- May: 72.7% overall, a 4.9% increase

- June: 68.7% overall, a 6.5% increase

There is an anticipated 75.1% occupancy in Q2 2024, a 10.1% increase compared to last year.

We predict the Group Business segment to occupy 32.1% of total occupied rooms, a 21.65% increase from Q2 2023. They will also see the biggest change overall, at 35.9% higher than last year.

Promotional Discount room occupancy is expected to make a big leap, up 17.8% compared to Q2 2023. Although they make up the second largest occupancy percentage, we predict a dip for Bar/Rack. This segment is expected to see a decrease of about 3.8% when compared to Q2 2023.

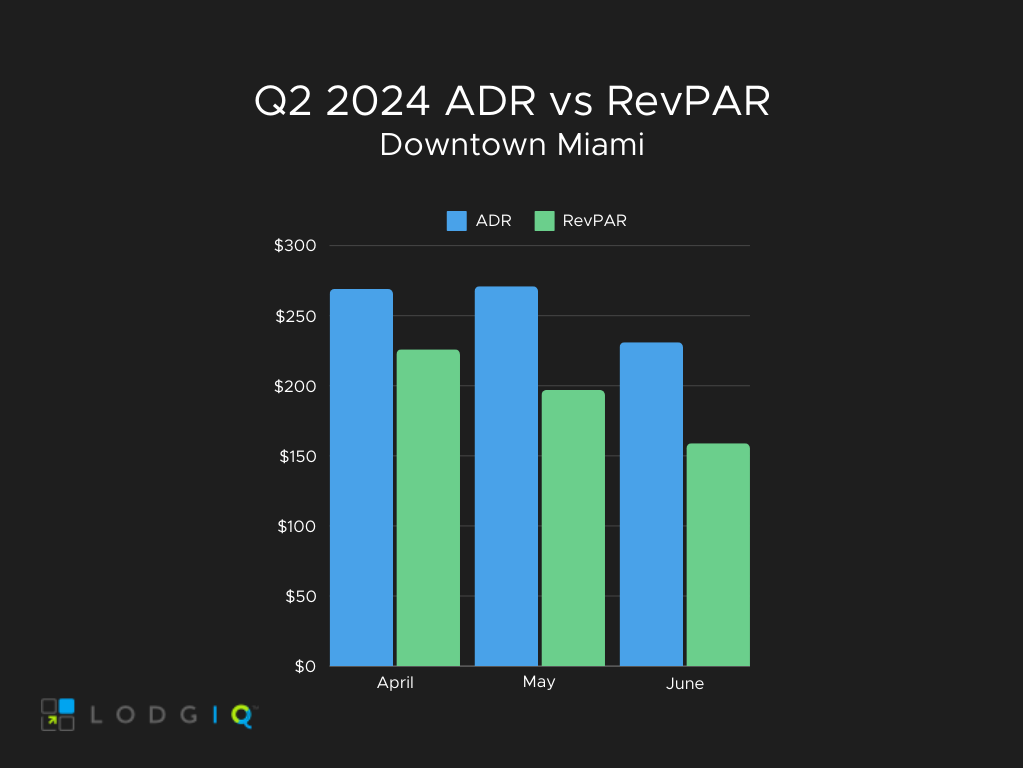

Q2 2024 Downtown Miami ADR

Expected ADR for the Downtown Miami market in Q2 2024 (plus change compared to Q2 2023)

- April: $269, a 3.3% increase

- May: $271, a 7.3% increase

- June: $231, a 14.5% increase

We predict the Q2 ADR for the entire Downtown Miami market to be $258, up 7.9% from Q2 2023.

Bar/RACK is expected to have the highest ADR ($323), up 8.8% when compared to Q2 2023. Proportionately, Bar/RACK will have the highest ADR by segment each month.

- April: $342

- May: $344

- June: $282

Q2 2024 Downtown Miami RevPAR

We predict RevPAR to be $194 in Q2 2024 in the Downtown Miami market, an 18.8% increase compared to Q2 2023.

Expected RevPAR for the Downtown Miami market in Q2 2024 (plus change compared to Q2 2023)

- April: $226, a 22.5% increase

- May: $197, a 12.5% increase

- June: $159, a 22% increase

Promotional Discounts are projected to have the biggest RevPAR changes of the segments, up 37.1% from 2023. This will account for 24.1% of overall RevPAR.

Group Discounts will make up 32.9% of revenue, up 10.4% when compared to Q2 2023.

Wholesale is expected to drop to just 2.9% revenue per available room, down 17.1% compared to Q2 2023.

Implications

- This significant expected increase suggests a thriving market with high demand.

- The main driver behind this RevPAR growth appears to be both occupancy and ADR.

Greater Miami Beach Q2 2024 Forecast

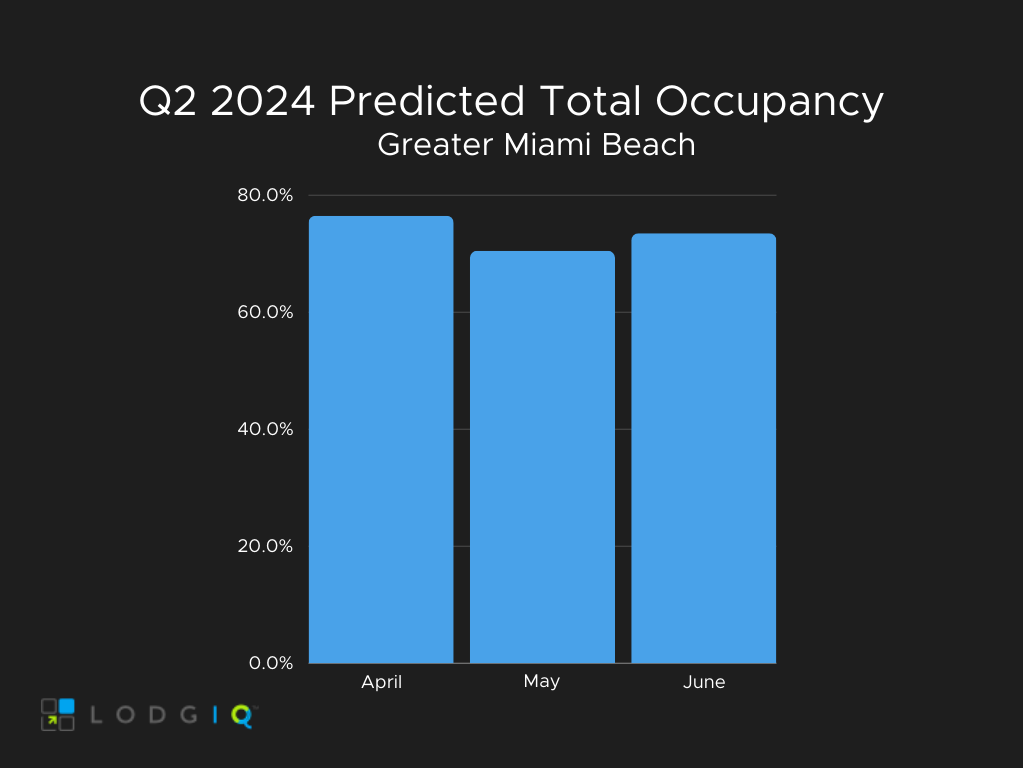

Q2 2024 Greater Miami Beach Market Total Occupancy

Expected occupancy for the Greater Miami Beach market in Q2 2024 (plus change compared to Q2 2023)

- April: 76.5% overall, a 2.4% increase

- May: 70.5% overall, a 2.8% increase

- June: 73.5% overall, a 5.2% increase

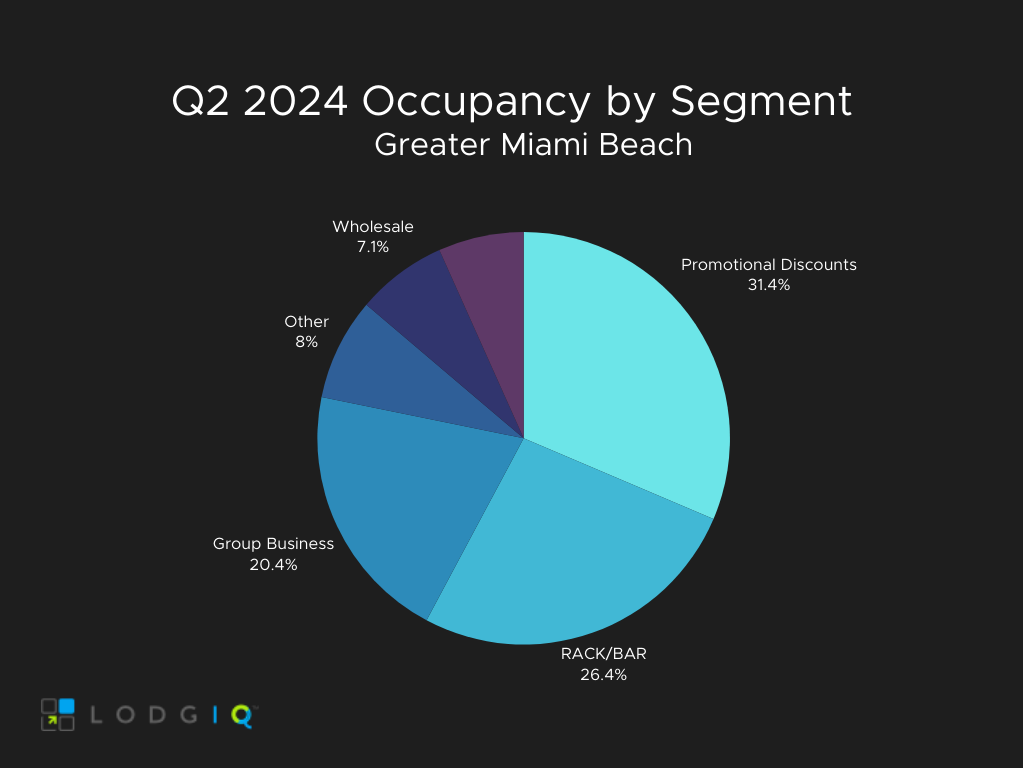

We anticipate Greater Miami Beach hotels to be at 73.5% average occupancy in Q2, a 3.4% increase over last year.

We predict the Promotional Discounts segment to occupy 31.4% of total occupied rooms, a 0.6% decrease from Q2 2023.

Group rates will see the highest increase in total occupied rooms, jumping up 18.6% from Q2 2023 occupancy with 17.2% to 20.4% for this year.

Bar/RACK occupancy will make up the second-largest group, but we are expecting to see a dip. We predict a decrease of about 6% when compared to Q2 2023.

Q2 2024 Greater Miami Beach ADR

Expected ADR for the greater Miami Beach market in Q2 2024 (plus change compared to Q2 2023)

- April: $468, a 4.4% increase

- May: $417, a 2.4% increase

- June: $324, an 8% increase

We predict the Q2 ADR for the entire Greater Miami Beach market to be $404, up 4.4% from Q2 2023.

Negotiated/Corporate Business is expected to have the highest ADR ($602), up 10.3% when compared to Q2 2023. Proportionately, Negotiated/Corporate Business will have the highest ADR by segment each month.

- April: $658

- May: $633

- June: $501

Qualified (senior and employee discount and AAA was just included in “other” previously) business is expected to have the highest increase year over year, up 15.7% for an ADR of $295.

Q2 2024 Greater Miami Beach RevPAR

We predict RevPAR to be $297 in Q2 2024 in the Greater Miami Beach market, an 8% increase compared to Q2 2023.

Expected RevPAR for the Greater Miami Beach market in Q2 2024 (plus change compared to Q2 2023)

- April: $359, a 6.9% increase

- May: $294, a 5.3% increase

- June: $238, a 13.4% increase

Group Business is projected to have the biggest RevPAR changes of the segments, up 12.5% from 2023. This will account for 21.3% of overall RevPAR.

Promotional Discount ($88) will make up 29.6% of revenue, a slight drop of 0.7% when compared to Q2 2023.

Rack/BAR revenue per available room is also expected to be $88. This will be down 3.9% from Q2 2023.

Implications

- Despite a slightly lower anticipated RevPAR growth compared to Downtown Miami, the Greater Miami Beach market will still be growing.

- The increase in RevPAR in Greater Miami Beach will be primarily driven by ADR.

South Beach Q2 2024 Forecast

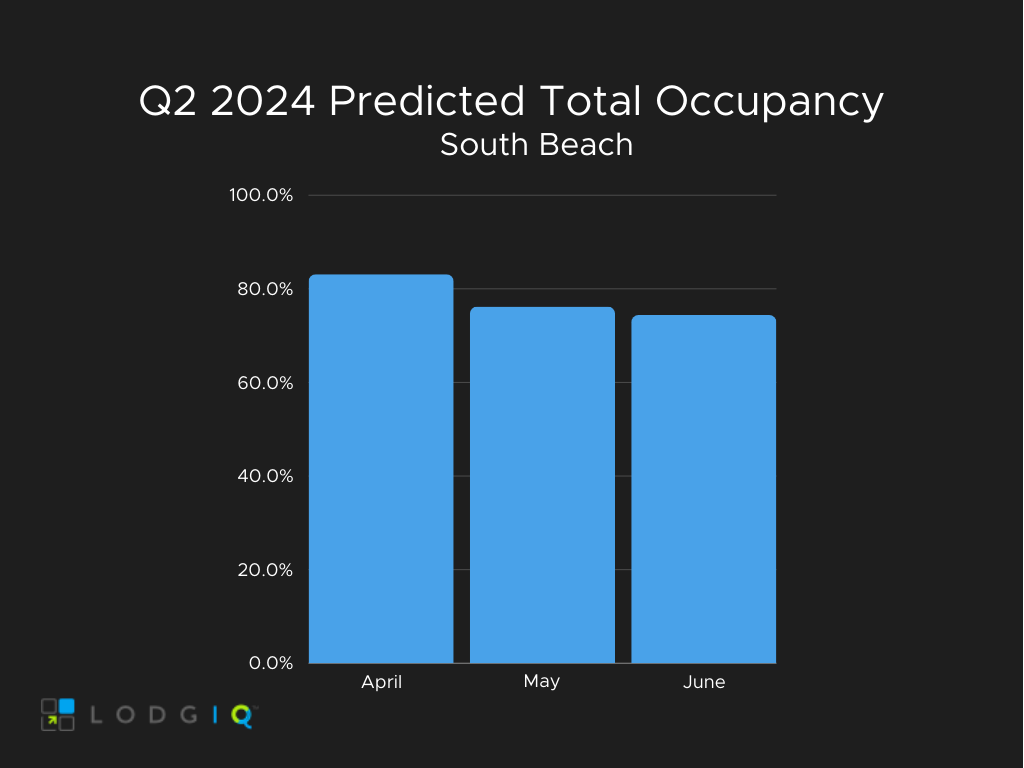

Q2 2024 South Beach Market Total Occupancy

Expected occupancy for the South Beach market in Q2 2024 (plus change compared to Q2 2023)

- April: 83.1% overall, an 11.2% increase

- May: 76.2% overall, a 10.4% increase

- June: 74.4% overall, a 9.9% increase

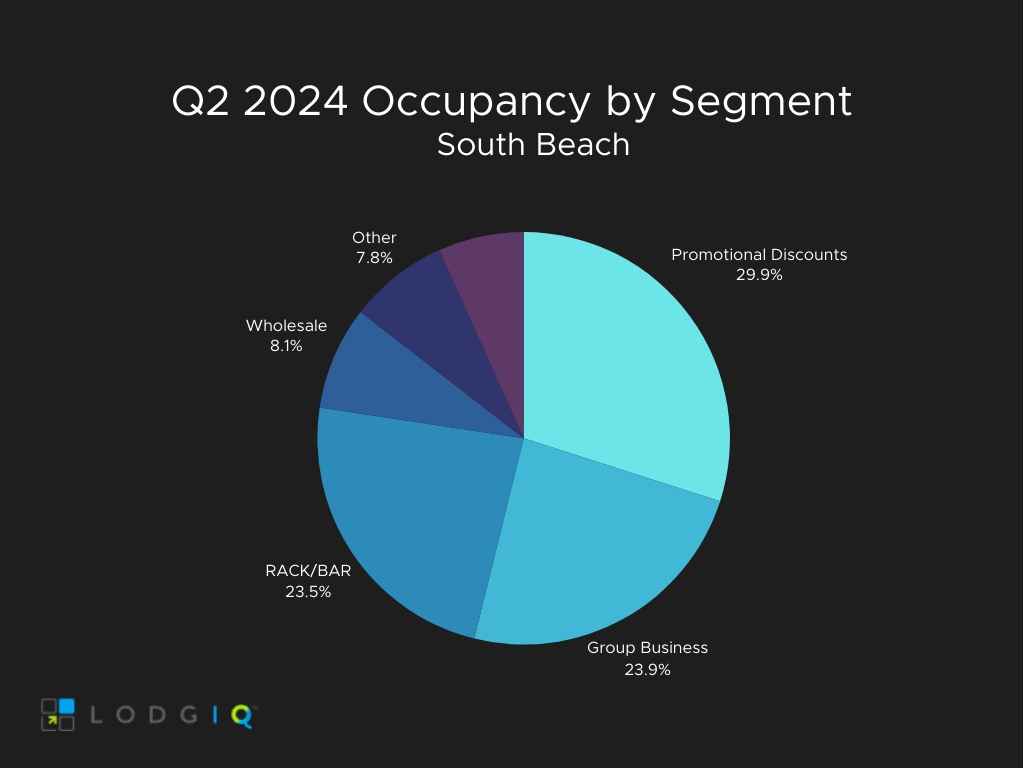

We predict 77.9% occupancy in Q2 2024, a 10.5% increase compared to last year. The highest percentage increase across all segments comes from Group Business, which is up 39.9% from 2023. It will account for 18.6% of total occupied rooms.

We predict the Promotional Discounts will have 29.9% of total occupied rooms, down 7.4% from Q2 2023. Bar/RACK will be the second highest total of occupied rooms, at 23.5%. This is also down from Q2 2023 by 10.3%.

Q2 2024 South Beach ADR

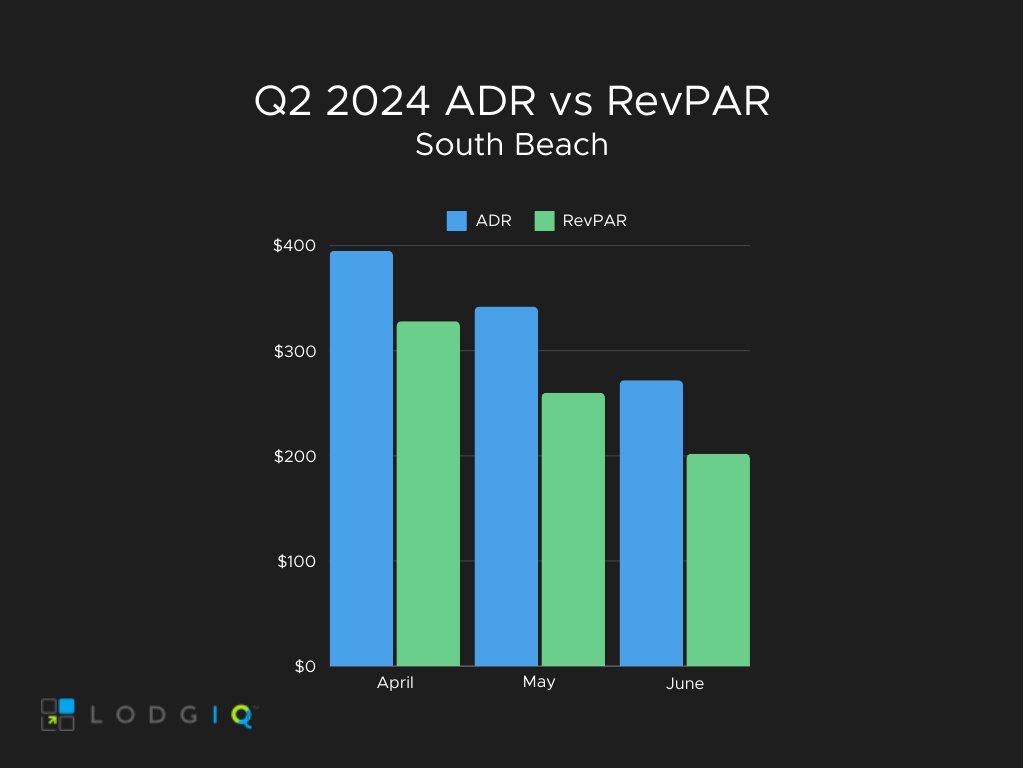

Expected ADR for the South Beach market in Q2 2024 (plus change compared to Q2 2023)

- April: $395, a 0.2% decrease

- May: $342, a 5.6% decrease

- June: $272, a 3.5% decrease

We predict the Q2 ADR for the entire South Beach market to be $339, down 3% from Q2 2023.

Negotiated/Corporate Business is expected to have the highest ADR ($519), up 2.6% when compared to Q2 2023. Overall, it will have the highest ADR by segment each month as well.

- April: $653

- May: $517

- June: $362

Qualified (senior and employee discount and AAA was just included in “other” previously) business is expected to have the highest increase year over year, up 7.4% for an ADR of $277.

Q2 2024 South Beach RevPAR

We predict RevPAR to be $264 in Q2 2024 in the South Beach market, a 7.2% increase compared to Q2 2023.

Expected RevPAR for the South Beach market in Q2 2024 (plus change compared to Q2 2023)

- April: $328, a 10.9% increase

- May: $260, a 4.3% increase

- June: $202, a 5.9% increase

Group Business ($61) is projected to have the biggest RevPAR changes of the segments, up 27.1% from 2023. This will account for 23% of overall RevPAR.

Wholesale ($16) is also expected to rise 23.1% from Q2 2023; however, this is only anticipated to be 6.3% of overall RevPAR.

Both Promotional Discounts and Rack/BAR revenue per available room will be down 9.6% compared to Q2 2023.

Implications

- South Beach will experience positive RevPAR growth but slightly lower than Downtown Miami and Greater Miami Beach.

- The RevPAR growth here will be predominantly driven by occupancy.

- Although ADR is expected to decrease by 3%, occupancy is projected to increase by 10.5%, showing that increased room occupancy is the primary factor contributing to growth.

Unite Your Revenue, Sales, and Marketing Teams

LodgIQ’s strategic platform integrates fragmented data sources, employing AI-driven analysis to offer strategic recommendations for the three key operational departments of your hotel: Revenue, Sales, and Marketing.

Get in touch with us if you’re looking for comprehensive market insights and forward-looking consumer buying behavior that you can’t find in any revenue management platforms used by hotels today.