You’re looking at LodgIQ’s Q1 2024 Hotel Forecast for the Manhattan market. This report provides insights into new trends to expect across all segments in the Manhattan market during Q1 2024.

The data in this report isn’t just a target. It’s a precise prediction based on a comprehensive analysis of multiple data sources, including an analysis of current buying behavior and pace cross-referenced by segment, past sales patterns, upcoming flight schedules, customer footfall, expected weather, current buying behavior, and current events.

We did all of this to help your sales, marketing, and revenue teams make informed decisions for your hotel. Think of this report like a crystal ball for your Manhattan hotel, LodgIQ your fortune tellers.

The LodgIQ commercial strategy platform is built to help your revenue, sales, and marketing teams work from the same data to make informed decisions.

Our platform doesn’t just present data. It provides recommendations.

It doesn’t just help maximize revenue. It helps you maximize profit.

This report is just a taste of those insights. Reach out if you want to hear more.

Methodology

We looked at three metrics — occupancy, ADR, and RevPAR — across the Manhattan market as a whole and three hotel classes — three, four, and five-star hotels.

Our data looks at 5 segments:

- Group Business like group tours, conventions, and non-negotiated corporate rates

- Promotional Discounts like advanced purchases and promotional packages

- Negotiated/Corporate Business

- RACK/BAR like best available and “off the rack” customer demand

- Wholesale like tour operators or consolidators

Key Takeaways

- Both five-star and four-star hotels are projected to have the same increase in occupancy and ADR (13% and 4.5%, respectively).

- Three-stars are expected to have 83.8% occupancy for all of Q1, the highest of the classes.

- Three-stars will sacrifice rate for occupancy, which will result in the highest RevPAR growth of the hotel classes.

- Three-stars will have the highest RevPAR growth but the lowest expected growth in ADR.

- Group Business will have the highest overall increase in occupancy rates and revenue.

- Negotiated/Corporate Business rates are anticipated to experience a decline of 9.3% in occupancy across all classes of hotels. As a result, it’s expected that the amount of money coming from Negotiated/Corporate Business rates will decrease in most hotel classes.

- Despite their decline in occupancy, Negotiated/Corporate Business rates will exhibit the highest expected percentage change in RevPAR in certain segments, suggesting a focus on maximizing revenue despite reduced occupancy.

Manhattan Q1 2024 Forecast

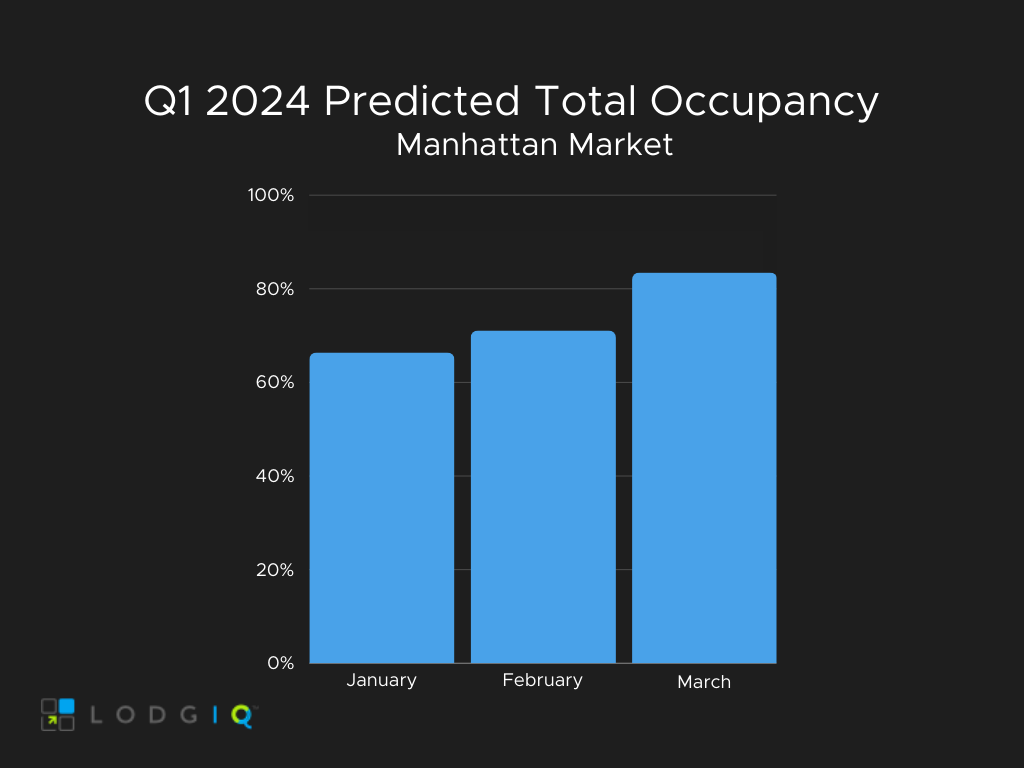

Q1 2024 Manhattan Market Total Occupancy

Expected occupancy for the Manhattan market in Q1 2024 (plus change compared to Q1 2023):

- January: 66.4%, a 0.8% increase

- February: 71.1% overall, a 3.6% increase

- March: 83.5% overall, a 4% increase

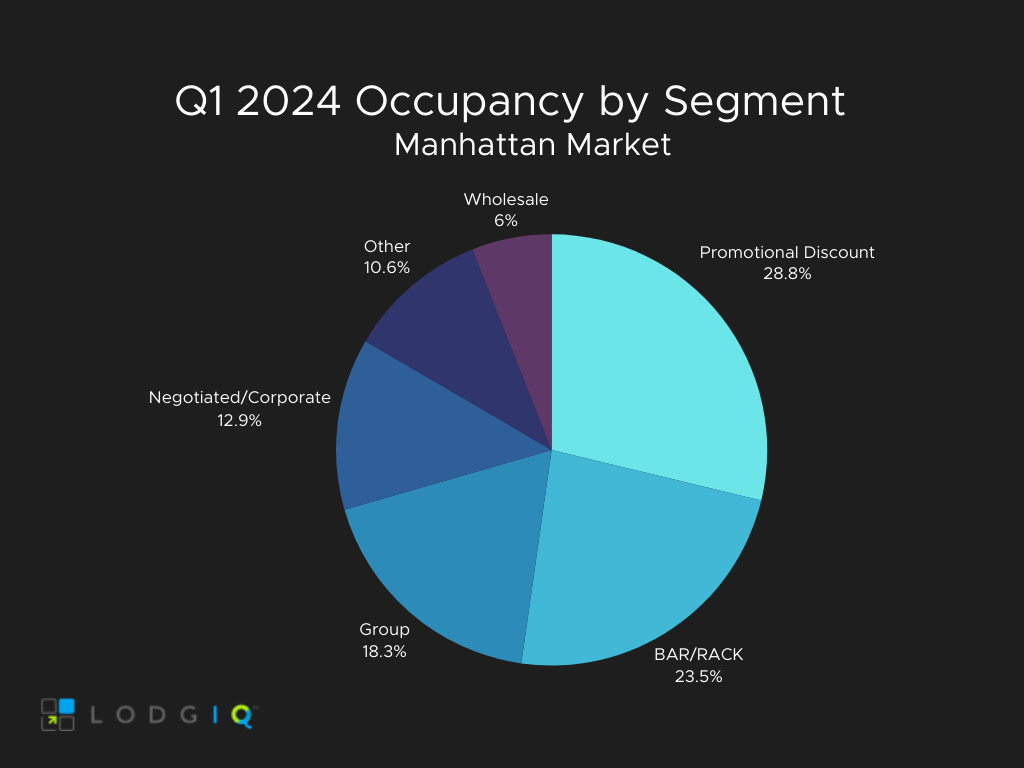

We predict the Group Business segment will occupy 18.3% of total occupied rooms, a 9.6% increase from 2023. Promotional Discount and RACK/BAR are expected to make up the bulk of occupancy, but that remains similar to last year (about 1% decrease in both segments).

We predict 73.9% total occupancy in Q1 2024, a 2.9% increase compared to last year. Most occupancy, 28.8%, is expected to come from discount rates, though that will be the same as last year.

We predict a dip in Negotiated/Corporate Business occupancy. They’re expected to occupy just 12.9% of rooms, a 7.8% decrease compared to Q1 2023.

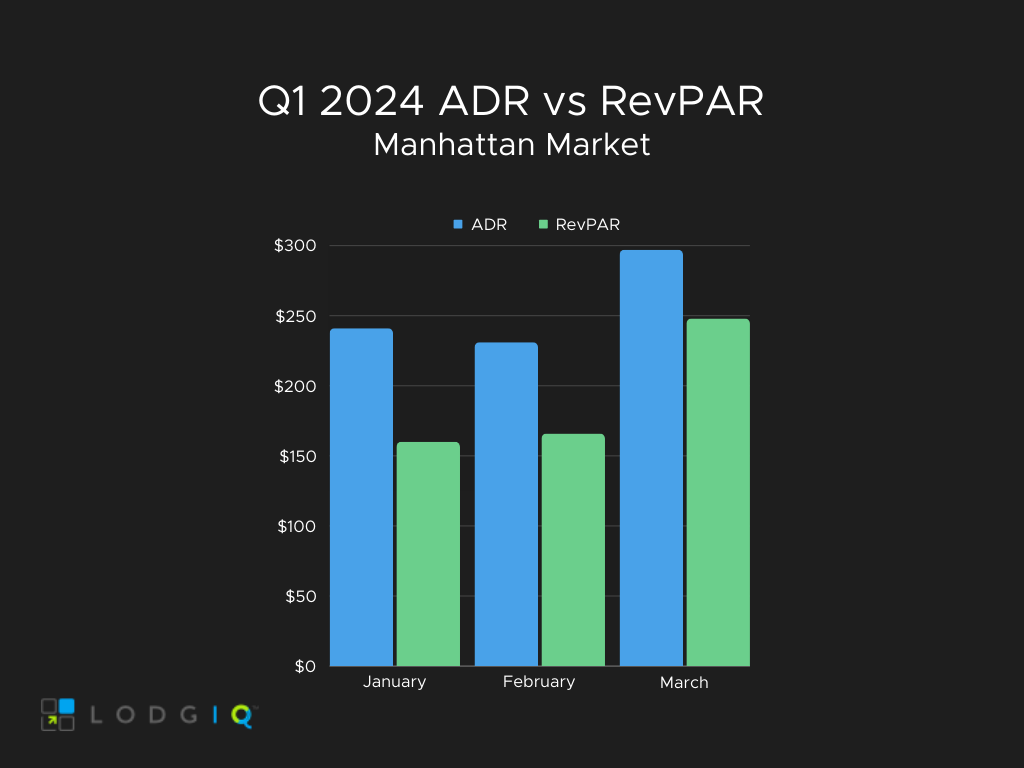

Q1 2024 Manhattan ADR

Expected ADR for the Manhattan market in Q1 2024 (plus change compared to Q1 2023):

- January: $241, a 6.4% increase

- February: $231, a 0.9% increase

- March: $297, a 2.8% increase

We predict the Q1 ADR for the entire Manhattan market to be $256.33, an increase of 3.6% compared to Q1 2023.

Negotiated/Corporate Business rates are expected to have the highest ADR ($325), up 2.8% compared to Q1 2023. Proportionately, Negotiated/Corporate Business rates will have the highest ADR by segment each month:

- January: $304

- February: $296

- March: $362

Wholesale is expected to have the highest increase year over year, up 6.6% for an ADR of $193.

Q1 2024 Manhattan RevPAR

We predict RevPAR to be $191.33 in Q1 2024 in the Manhattan market, a 6.7% increase compared to Q1 2023.

Expected RevPAR for the Manhattan market in Q1 2024 (plus change compared to Q1 2023):

- January: $160, a 7.2% increase

- February: $166, a 4.6% increase

- March: $248, a 6.9% increase

Promotional Discounts and RACK/BAR are projected to have the biggest RevPAR changes of the segments, both up 4.0% from 2023. Together, they will make up over half, 52.8%, of revenue in Q1 2024.

Group business will make up 18.8% of revenue, an 8% increase compared to Q1 2023, the highest increase of the segments.

Conversely, Negotiated/Corporate Business revenue per available room will be down 6.1% compared to Q1 2023.

Five-Star Hotel Q1 2024 Forecast

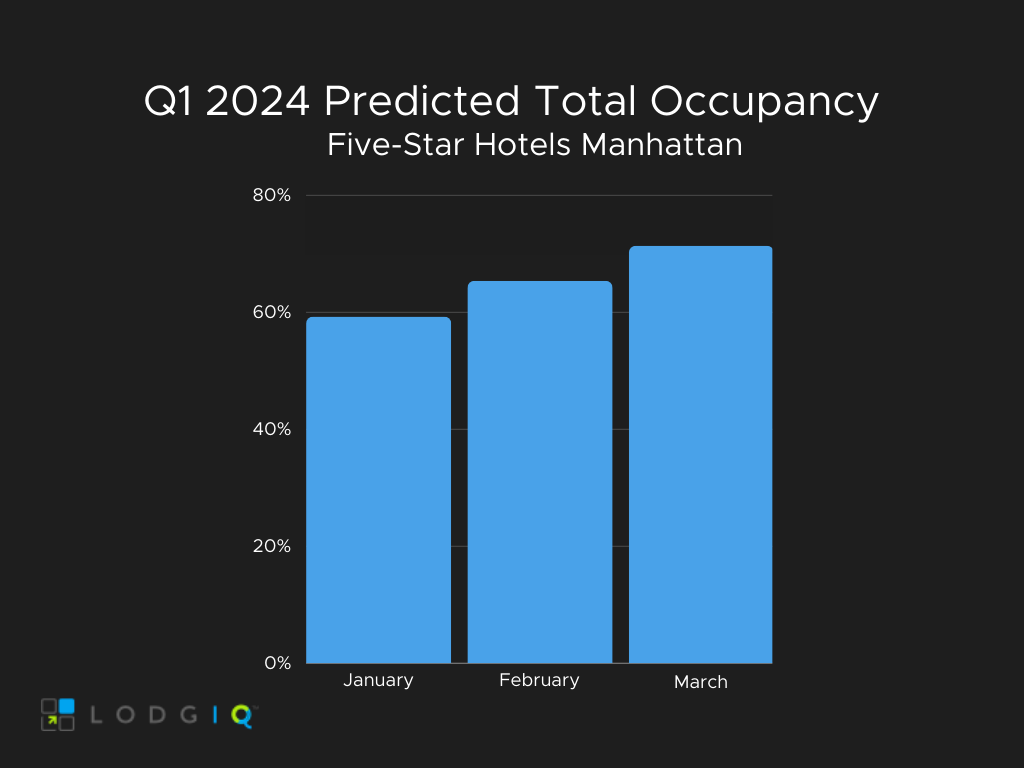

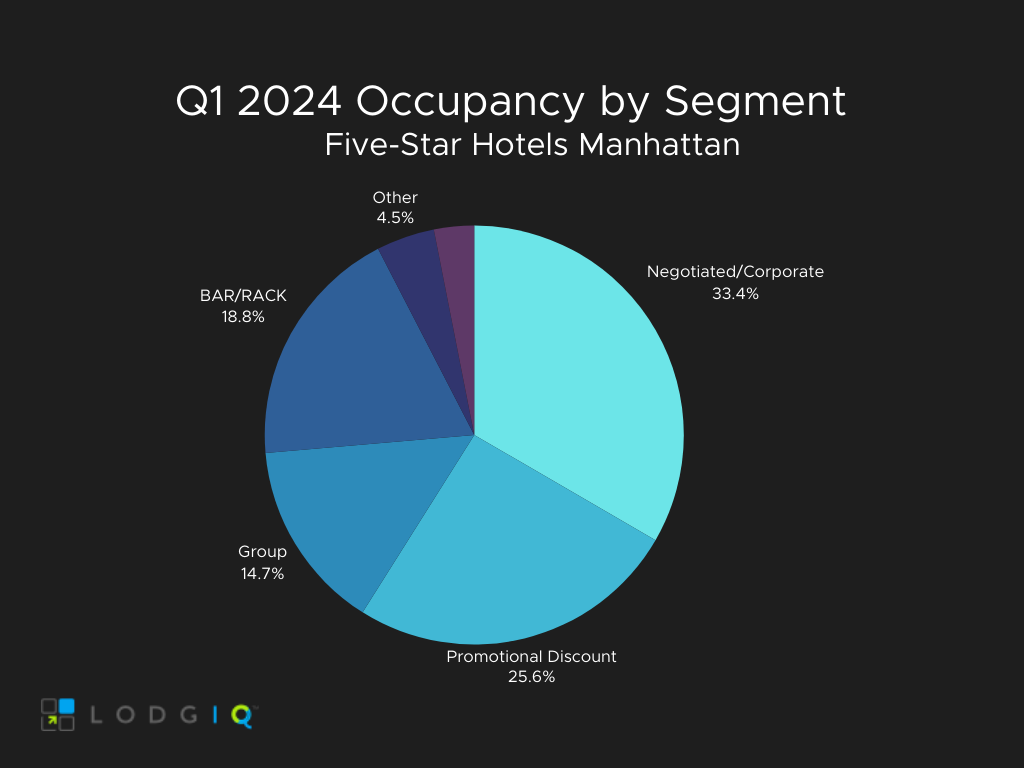

Q1 2024 Five-Star Hotel Occupancy

We anticipate five-star hotels to be at 65.4% average occupancy in Q1, a 13.1% increase over last year.

The Promotional Discount segment will occupy 25.6% of rooms, up 15.9% from 2023 and the highest expected increase in occupancy by segment.

We project a 6.4% drop in occupancy from the Negotiated/Corporate Business segment. Still, the Negotiated/Corporate Business segment will account for the highest contribution to the hotel’s overall mix with a 33.4% occupancy (accounting for 21.8% of the overall segment mix).

Expected occupancy for five-star hotels in Q1 2024 (plus change compared to Q1 2023):

- January: 59.3%, a 12.3% increase

- February: 65.4%, a 19.8% increase

- March: 71.4%, an 8.7% increase

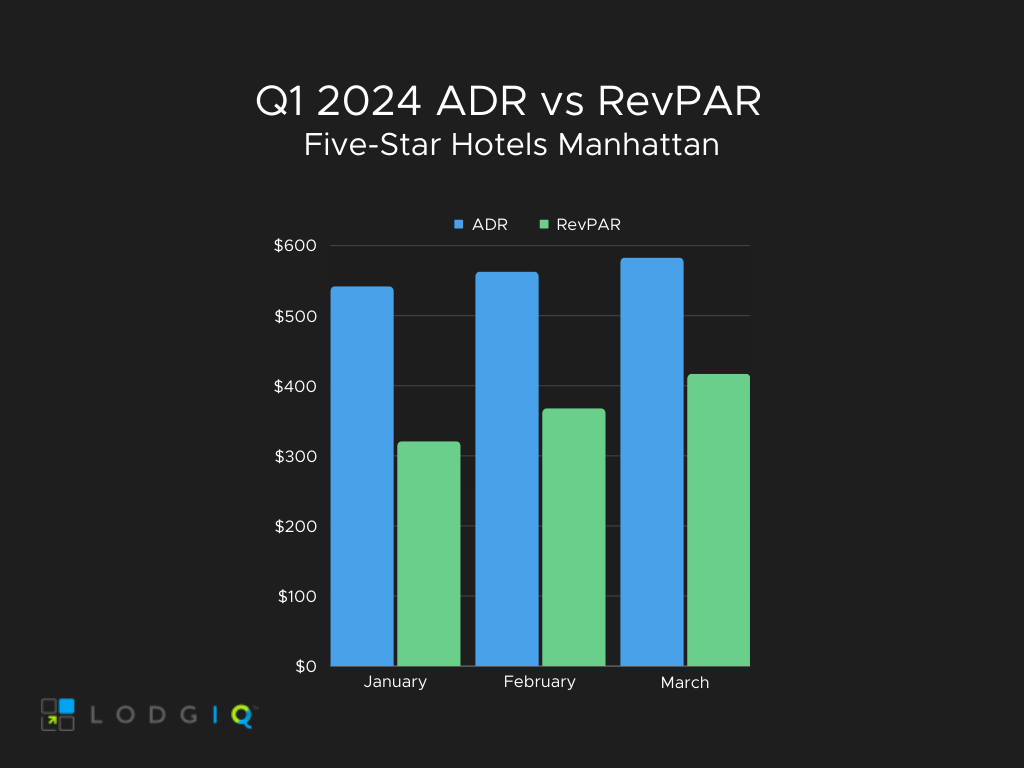

Q1 2024 Five-Star Hotel ADR

We expect five-star hotels to have an overall ADR of $562.70, a 4.5% growth compared to Q1 2023.

Expected ADR for five-star hotels in Q1 2024 (plus change compared to Q1 2023):

- January: $542, a 5.4% increase

- February: $563, a 7.3% increase

- March: $583, a 2% increase

The RACK/BAR segment will have the highest ADR each month:

- January: $661

- February: $649

- March: $688

And we expect Wholesale to have an ADR of $459, an increase of 18% compared to last year, the highest expected increase across segments.

Q1 2024 Five-Star Hotel RevPAR

We expect five-star hotels to have a RevPAR of $368.70, a significant 18.2% expected growth compared to Q1 2023.

We predict Group Business RevPAR will experience a 23% increase compared to Q1 2023, the highest expected percentage increase in RevPAR across segments.

Expected RevPAR for five-star hotels in Q1 2024 (plus change compared to Q1 2023):

- January: $321, an 18.3% increase

- February: $368, a 28.5% increase

- March: $417, a 10.9% increase

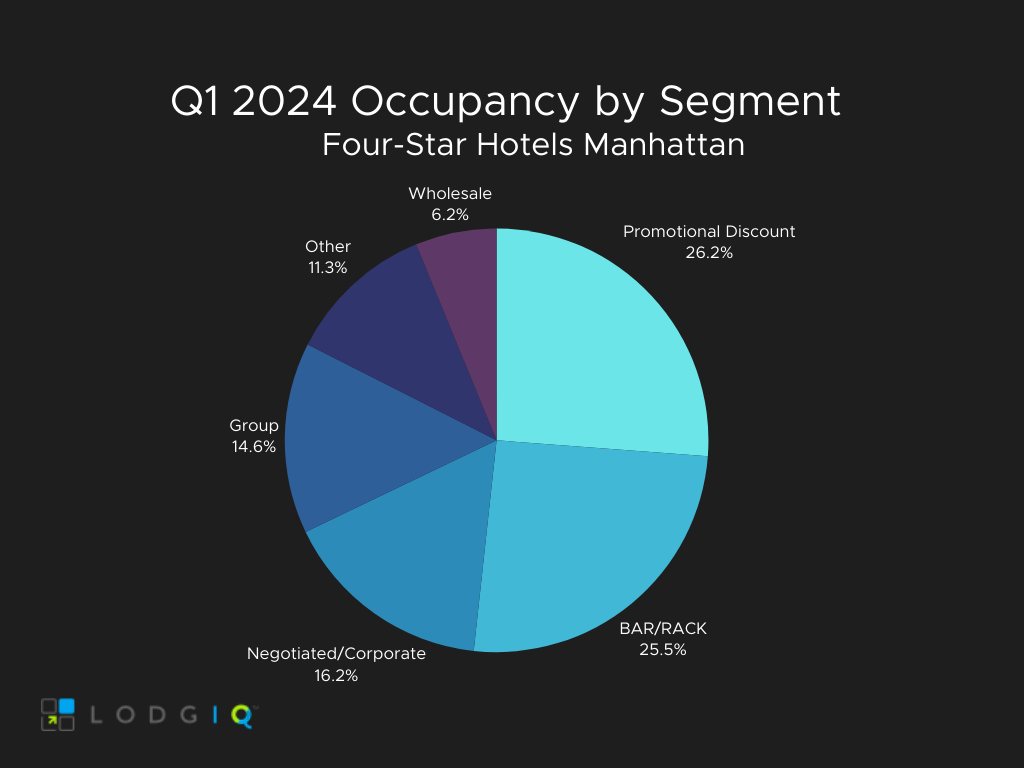

Four-Star Hotel Q1 2024 Forecast

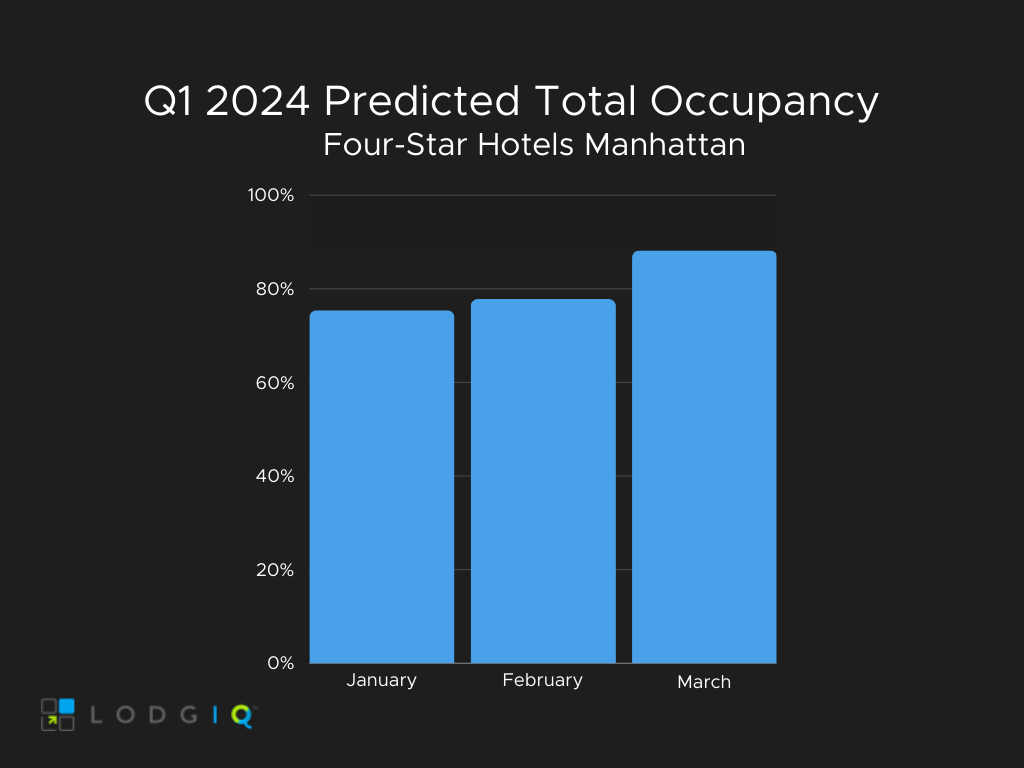

Q1 2024 Four-Star Occupancy

We anticipate four-star hotels to be at 80.5% average occupancy in Q1, a 13.2% increase over last year.

Negotiated/Corporate Business and RACK/BAR will have the highest expected percentage increase across segments compared to Q1 2023, at 32% and 29.8%, respectively.

Expected occupancy for four-star hotels in Q1 2024 (plus change compared to Q1 2023):

- January: 75.4%, a 14.9% increase

- February: 77.8%, a 14.6% increase

- March: 88.2%, a 10.1% increase

The highest expected occupancy in January and February will come from Promotional Discount rates, which is at 20% for occupancy for both months.

Most occupancy in March will come from RACK/BAR and Promotional Discount rates, 24% and 23.5%, respectively, for a total occupancy of 47.5%.

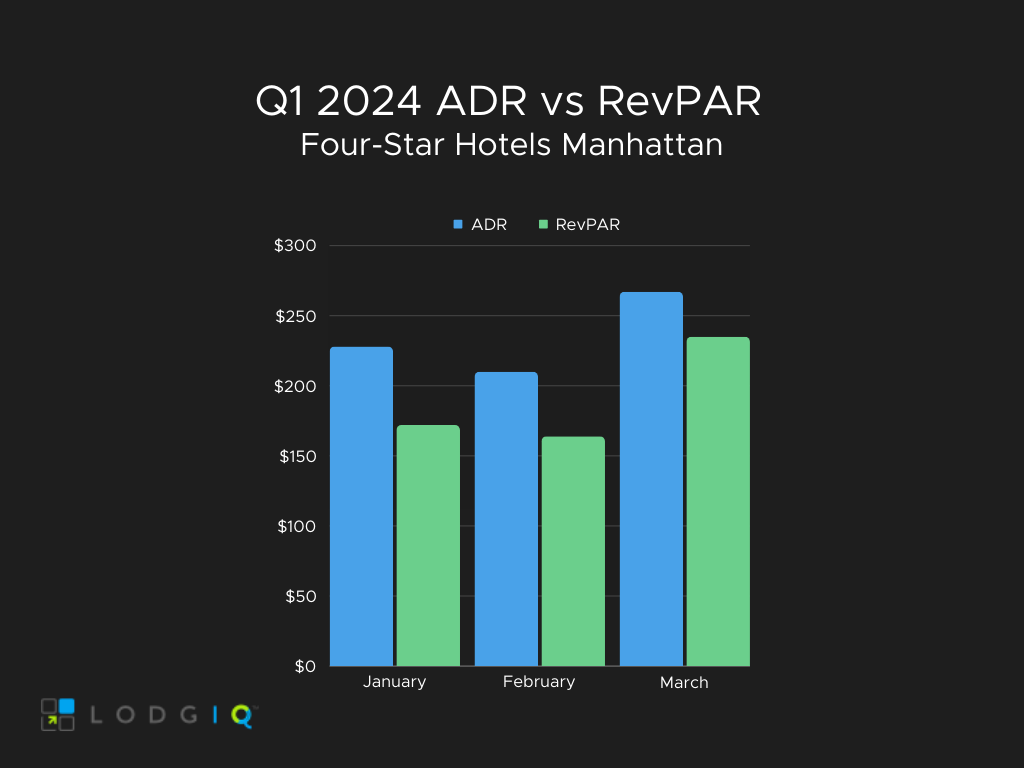

Q1 2024 Four-Star Hotel ADR

We expect four-star hotels to have an overall ADR of $235, a 4.5% growth compared to Q1 2023.

Expected ADR for four-star hotels in Q1 2024 (plus change compared to Q1 2023):

- January: $228, an 11.1% increase

- February: $210, a 1.4% increase

- March: $267, a 1.9% increase

The Negotiated/Corporate Business segment will have the highest ADR in both January and March:

- January: $253

- March: $316

The Group Business segment will have the highest ADR in February at $244.

Both Negotiated/Corporate Business and Group Business will account for the highest projected ADR, with $269 and $266, respectively. Group Business will see the highest expected percentage increase at 9%.

Q1 2024 Four-Star Hotel RevPAR

We expect four-star hotels to have a RevPAR of $190.33, a significant 18.5% increase compared to Q1 2023.

Negotiated/Corporate Business rates will have the highest expected percentage change in RevPAR at 37.5%. They are expected to account for 15.6% of purchases, which is up 18.5% from 2023.

RACK/BAR ($52) and Promotional Discounts ($46) account for the highest RevPAR at 27.5% and 24.2%, respectively.

Expected RevPAR for four-star hotels in Q1 2024 (plus change compared to Q1 2023):

- January: $172, a 27.7% increase

- February: $164, a 16.4% increase

- March: $235, a 12.1% increase

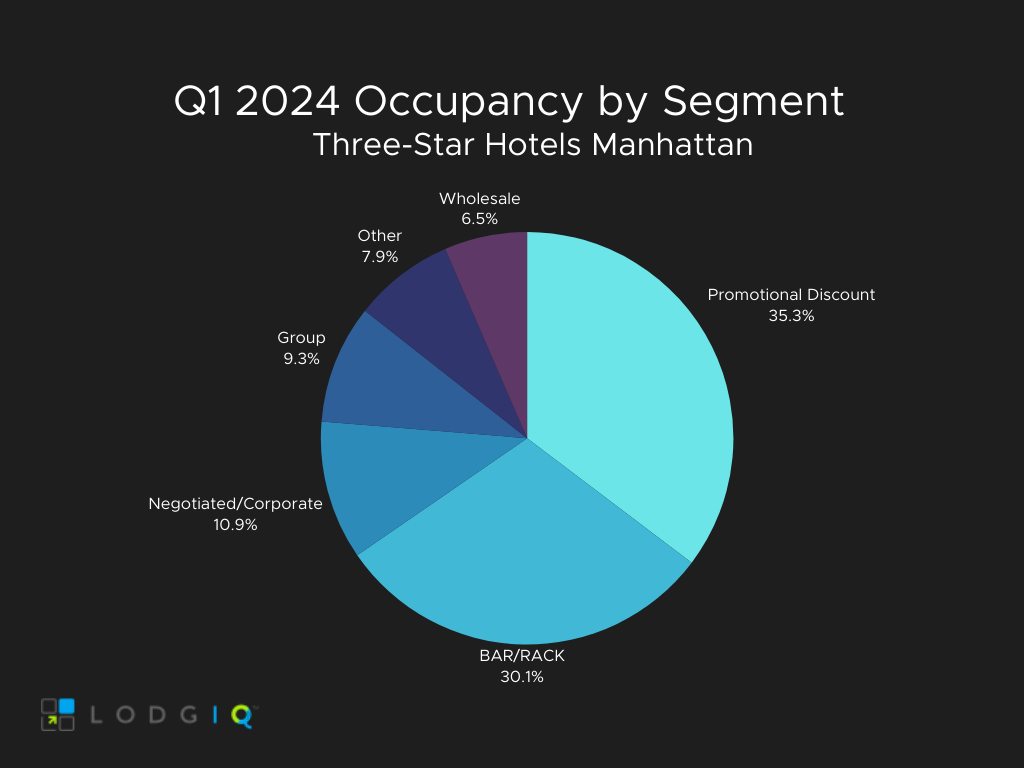

Three-Star Hotel Q1 2024 Forecast

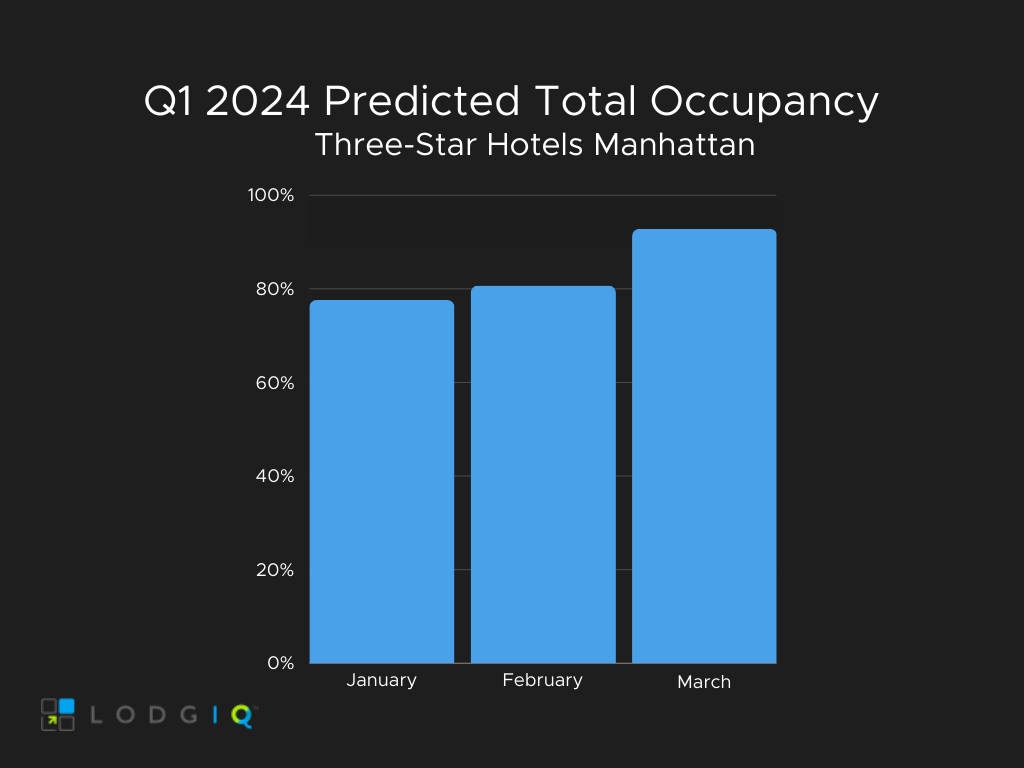

Q1 2024 Three-Star Occupancy

We anticipate three-star hotels to be at 83.8% average occupancy in Q1, an 18.7% increase over last year.

Group Business (7.8%) and Negotiated/Corporate Business (9.1%) occupancy rates will have increases of 53.0% and 35.8%, respectively, the highest of any segment.

We project a 3% drop in occupancy from the Promotional Discount segment. Still, this segment will account for the highest percentage of the hotel’s overall mix with a 35.3% occupancy (accounting for 29.5% of the overall segment mix)

Expected occupancy for three-star hotels in Q1 2024 (plus change compared to Q1 2023):

- January: 77.6%, an 18.8% increase

- February: 80.7%, an 18.3% increase

- March: 92.8%, an 18.8% increase

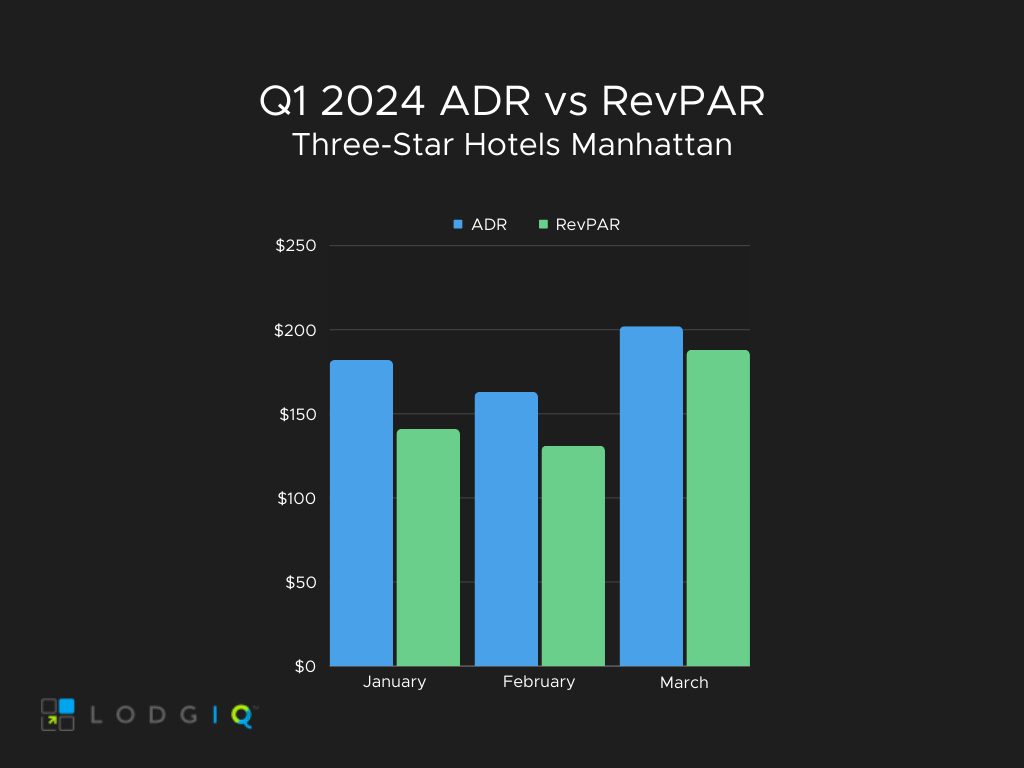

Q1 2024 Three-Star Hotel ADR

We expect three-star hotels to have an overall ADR of $184, a 2.5% growth compared to Q1 2023.

Expected ADR for three-star hotels in Q1 2024 (plus change compared to Q1 2023):

- January: $182, a 14.8% increase

- February: $163, a 1.3% increase

- March: $202, a 4.3% decrease

Both Negotiated/Corporate Business rates and RACK/BAR will account for the highest projected ADR, with $208 and $205, respectively.

The Negotiated/Corporate Business segment will have the highest ADR in both February and March:

- February: $186

- March: $238

RACK/BAR will be the only segment that outperforms Negotiated/Corporate Business for ADR in January:

- January: $206

Negotiated/Corporate Business rates are expected to rise 6.2% from 2023, the biggest growth of all segments. Group Business will also account for a good amount of the market, at $198 expected ADR. This is up 5.0% from 2023.

Q1 2024 Three-Star Hotel RevPAR

We expect three-star hotels to have a RevPAR of $154.00, a significant 21.5% expected growth compared to Q1 2023.

Group Business rates will have the highest expected percentage change in RevPAR at 66.3%. They are expected to account for 9.3% of purchases, which is up 31% from 2023.

RACK/BAR ($52) and Promotional Discounts ($50) account for the highest RevPAR with 66.2% of revenue combined.

- RACK/BAR RevPAR is projected to increase 30.0% in 2024.

- They are expected to account for 33.7% of purchases, up 10.1% from 2023.

- Promotional Discount rates are projected to increase 8.6% in 2024.

- They are expected to account for 32.5% of purchases. This is 9.2% lower than 2023.

Expected RevPAR for three-star hotels in Q1 2024 (plus change compared to Q1 2023):

- January: $141, a 36.5% increase

- February: $131, a 19.9% increase

- March: $188, a 13.6% increase

- RACK/BAR will be:

- 2% lower than January 2024

- 2% lower than February 2024

- Promotional Discount will be:

- 5% higher than January 2024

- 6% higher than February 2024

- They both will account for 32.9% of overall RevPAR, 181.8% higher than any other segment that month.

- RACK/BAR will be:

Your Hotel’s Future Looks Bright With LodgIQ

LodgIQ’s commercial strategy platform consolidates siloed data and provides AI-based analysis and strategic recommendations for your hotel’s three operational departments — Revenue, Sales, and Marketing.

Get in touch with us if you’re looking for comprehensive market insights and forward-looking consumer buying behavior that you can’t find in any revenue management platforms used by hotels today.