If you’ve scanned through the top news stories of the last few months, you’re likely well acquainted with the post-pandemic elephant in the room: record-high inflation. As expected, the collective (and prolonged) halt of global economies, the subsequent critical supply chain disruptions, and the ongoing war in Ukraine has placed significant pressure on the economic outlook. With inflation staying low over the last ten years (1.88% on average), the current rise (8% annual average in 2022) has begun to make ripples across industries, and hospitality is no exception.

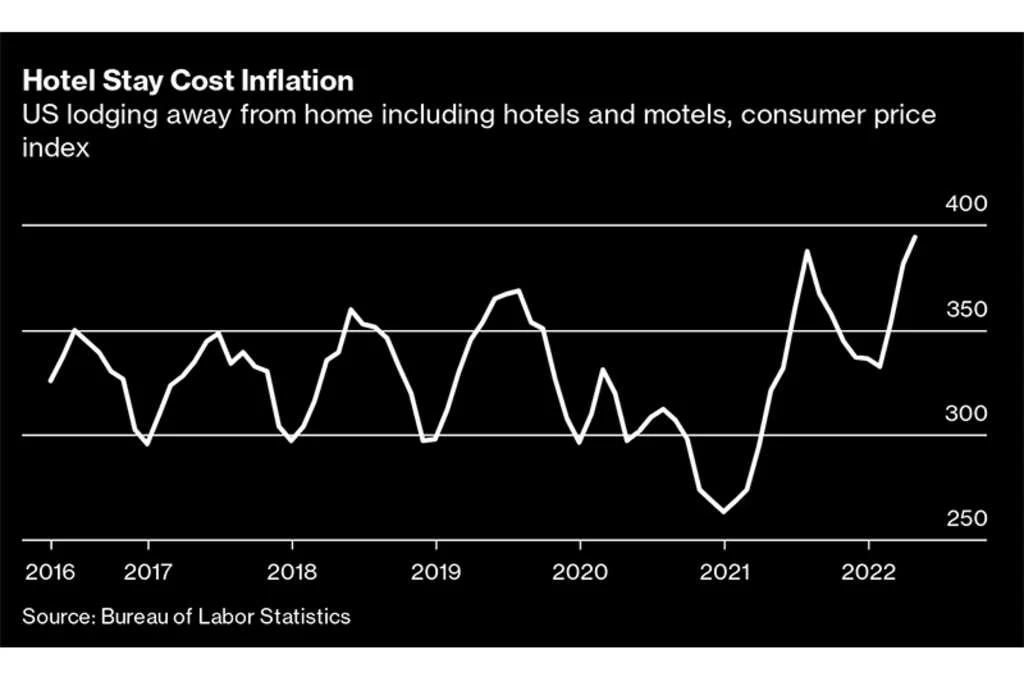

The latest set of inflation data, which the Bureau of Labor Statistics released in January 2023 based on December 2022 data, showed a 0.1% dip in prices from November. But despite the good news of mostly dropping prices this month, travel costs are far higher than they were in the past. According to a study by NerdWallet, hotel prices are still very much on the rise.

Now, as central bank tightening continues to impact our experience at check-out, the question on hoteliers’ minds is this: should our industry adjust for inflation? Is it time to raise our hotel room rates? After all, if the costs of goods and services are steadily rising, shouldn’t the price of your offering increase to counteract the rising cost of running a hotel?

A Perfect Inflationary Storm

To this effect, a recent American Express Global Business Travel report revealed that hotel rates worldwide will increase again in 2023 thanks to pent-up demand. Moreover, in 2022 Hilton CEO Chris Nassetta predicted a significant surge in booking demand and, subsequently, Hilton’s performance the following summer as inflation first began to take hold. The price has gone up for everything, so we’re not different than when you go to a gas pump or the grocery store or any other aspect of life; it’s discretionary, Nassetta said on CNBC’s Squawk on the Street at the time.

Visit any hotel or travel booking site, and you will quickly see the impact of inflation on hotel rates. Everywhere you look, room prices are soaring. But this price rise isn’t driven purely by inflationary pressures. The hotel industry is also experiencing unprecedented pent-up demand. Add to this the current labor shortage, and you have a perfect storm of inflationary factors to drive up the rates offered to travelers.

Lodging Prices are Aligned with Guest Demand

When we look at lodging price trends over the last two years, we see that lodging rates were up 3.2% from December 2021 to December 2022 and up 17% in December 2022 compared to December 2019 (pre-pandemic). In the wake of the pandemic, travelers are exhibiting a renewed appetite for travel and the experiences offered by hospitality brands. Even as households tighten budgets and reduce discretionary spending, there are a number of studies that indicate consumer interest in travel has remained largely unscathed.

To this effect, the U.S. Travel Foundation forecasts an increase in travel spending in 2023 compared to 2022 (and 2019). Similarly, a survey by Booking.com found that nearly half (49%) of its respondents said they are likely to spend more on their next trip to make up for lost time. Not only that, but 43% of respondents shared that they are willing to go “all out” when it comes to costs. Now, more than ever, travel has been revealed as a priority within otherwise restricted budgets, which is welcome news for our industry. However, hoteliers must use this information carefully to inform their revenue management efforts in a way that protects their current and future bottom line.

Should Hotels Drop or Increase Prices?

Unfortunately, there is no easy, one-size-fits-all answer to this question. When considering room pricing and revenue management, hotel brands must ensure their revenue generation strategies align with the big picture of their profit objectives. To determine gross operating profit per available room (GOPPAR), hoteliers can take total revenue, subtract total departmental and undistributed expenses, and then divide by the total number of available rooms.

To implement an effective revenue strategy, hotel brands must consider all revenue streams and cost variables, in addition to industry-wide trends and fluctuations, and make pricing decisions accordingly. Although people are less likely to make expensive purchases during economic downturns, the hospitality industry is benefitting from continued demand and, at the same time, must combat increased operational costs. With this in mind, hotels must consider the temperament of travelers (based on current and forecasted booking behavior trends) while also considering their margins and, ultimately, their bottom line. If this seems like a difficult job – that’s because it is. Fortunately, modern revenue management systems (RMS) are built to handle it.

As hotels look to reduce operational spending and optimize revenue in 2023, an effective RMS platform will reveal itself as a key indicator of success. Using the power of AI, hotels can leverage their RMS to “rate shop”; that is, view and compare the hotel prices by room types and analyze prices for current and past dates. These platforms also analyze market variables to optimize forecasts and room rates based on various critical factors (competitors, historical trends, flight patterns, current demand, local events, etc.). For room rates, specifically, an intuitive RMS will offer room-level optimization and rate push, which incorporates hotel performance, compset, room hierarchies, and, most importantly, dynamic ML algorithms to produce optimized recommendations.

The most profitable hotels are those whose pricing strategies reflect an ongoing balancing act between revenue goals, operational costs, and industry trends at local and global levels. With the right RMS, hotel brands of any size and scale can rest assured that their pricing strategy will remain dynamic and competitively advantaged, which will, in turn, ensure their hotel remains profitable and resilient to the impact of inflation.

About LodgIQ

LodgIQ™ provides advanced travel industry revenue optimization technologies. Its breakthrough next-generation revenue optimization platforms, LodgIQ RM were developed by seasoned revenue management executives and Silicon Valley technologists. Currently working with over 550 hotels LodgIQ’s products combine sophisticated machine learning with an intuitive and powerful user interface delivering advanced recommendations and actionable analytics. LodgIQ is headquartered in Silicon Valley, with offices in New York City, Phoenix, and Bangalore.