We’ve spent the past few weeks poring over the raw responses to our industry survey of hoteliers. One key point stood out: revenue leaders are navigating a market that’s both more opportunity-rich and more unforgiving than at any time in the past decade. Demand is back—but it’s different. Pricing power exists—but it’s fragile. Technology is abundant—but impact depends on execution. In what follows, I’ll share what we learned, how we read the signal beneath the noise, and what we, as operators and partners, are doing to help you turn volatility into outperformance.

Who We Heard From And How We Read The Data

We heard directly from hotel professionals across property sizes, segments, and regions—urban independents and branded resorts, select-service corridors and luxury lifestyle flags. Respondents spanned revenue management, sales, distribution, digital, and general management. Instead of treating every checkbox as equal, we grouped responses into patterns, triangulating what people say they do with what they say actually moves the needle. When conflicting signals emerged (and they did!), we weighted answers by role, ownership type, and property context. The result is not an academic paper; it’s a usable field guide.

The Demand Picture: Compressed, Event-Driven, And Uneven

Across segments, leisure remains resilient, but the character of leisure has changed. Shorter booking windows persist, and high-demand spikes cluster around events, sports, concerts, and school calendars. Business transient is rebuilding with wide regional variance; where corporate contracts lag, project-driven and small-team travel are filling some gaps. Group is the quiet catalyst of base demand: when group pace is healthy, everything else prices with more confidence. When it isn’t, teams lean harder on promotions and public discounting than they’d like. What this means for your property: treat events as micro-seasons with their own rules; rebuild weekday compression by pairing small-group pace with transient fences; and protect peak nights aggressively while adding value to shoulders.

Pricing: Beyond BAR—From Courage To Calibration

Hoteliers report that price experimentation is paying off most when it’s fast, bounded, and paired with crisp fences. Length-of-stay controls, dynamic minimum stays tied to on-the-books pace, and micro-fences (loyalty-only offers, mobile-exclusive perks, channel-limited packages) outperform blunt discounting. The recurring tension we saw: teams know they should test more, but fear whiplash. Our view: courage comes from calibration. Set a price-testing cadence with guardrails by date band and segment, then let automation execute within those bands. You don’t need perfect answers; you need consistent, defensible movements that compound gains over time.

Forecasting: The End Of “Set It And Forget It”

No one trusts static forecasts anymore—and that’s healthy. The best-performing teams in our sample update forecasts frequently, ingesting signals beyond historical pickup: flight searches and airlift, event ticketing, comp-set price volatility, weather anomalies, and even local school calendars. When uncertainty rises, they build scenarios, not single numbers. We do the same in our own work: base, stretch, and downside each get their own price posture and distribution plan. Practically, that means publishing a weekly forecast cadence and codifying what triggers a posture change—e.g., a competitor undercuts parity by a certain threshold, or group wash exceeds a set percentage two weeks out.

Distribution: Direct Is A Strategy, Not A Slogan

Direct share grows when it is made, not wished for. Respondents who saw direct acceleration weren’t just shouting “book direct”; they engineered it. Three patterns stood out. First, they made the mobile path to purchase radically easy, with clean rate names, one-tap room selection, and honest, immediate value (late checkout, F&B credit, parking). Second, they aligned paid media with revenue goals, bidding aggressively on event dates and easing off on need periods where wholesale could efficiently carry the load. Third, they treated metasearch as part of RM, not only marketing: real-time rate accuracy, parity policing, and bid adjustments tied to occupancy thresholds. The takeaway: direct is a disciplined operating rhythm linking revenue, e-commerce, and distribution—not a one-time campaign.

Technology: Integration Beats Features

Plenty of tools promise uplift. In practice, respondents told us the same story again and again: integration quality determines ROI. A modest feature set with clean, reliable data flows between PMS, CRS, RMS, and analytics will beat a flashier stack that drops bookings or lags sync. Where teams felt stuck, the root cause was rarely “missing AI”; it was broken basics—inventory mismatches, parity leaks, and untracked upsell revenue. We approach this with a bias for simplicity: fewer systems, fewer manual exports, fewer spreadsheets. When we add a capability, we ask one question first—does it reduce operational friction at the front desk and in the revenue meeting next Monday?

Talent And Process: Smaller Teams, Sharper Meetings

Most teams are leaner than they were, and that’s not always bad. Lean forces clarity. The best revenue meetings in our sample run on three beats: yesterday’s exceptions, this week’s tactical moves, and a rolling four-week outlook—each with owners and deadlines. Anything that doesn’t change price, inventory, or positioning goes to an async channel. We do the same internally: we lock in a weekly “pricing hour” where distractions are banned, dashboards are clean, and decisions are documented. Over time, that habit becomes your competitive moat.

Risk Management: Parity, Cancellations, And Payment Friction

Three operational risks surfaced repeatedly. First, rate leakage and opaque channels quietly erode pricing power; left unchecked, they train your customers to shop forever. Second, cancellation behavior remains elevated in certain markets, demanding tighter deposit rules and pre-arrival engagement to firm intent. Third, payment friction still costs bookings—especially on mobile. Properties that normalized modern payment options, pre-stay checkout, and clear refund rules reported fewer abandoned carts and fewer disputes. The fix is rarely glamorous: audit parity weekly, model cancellation risk into pricing, and make it absurdly easy to pay and confirm.

What We’re Doing Differently Because Of This Survey

We’re leaning into scenario planning and signal-driven pricing. That means combining on-the-books pace with external demand signals; allowing price tests to run within clear guardrails; and hard-wiring event calendars into our strategy templates so every concert, conference, and school break gets the treatment of a mini-season. We’re also doubling down on integration. Every new feature we build or adopt must reduce manual effort, improve data reliability, and surface decisions in the workflows teams already use. Finally, we’re investing in practical education—the kind you can apply tomorrow morning, not just admire in a slide deck.

A Pragmatic Action Plan You Can Run This Quarter

- Define your “micro-season” calendar. List recurring events, school breaks, stadium schedules, festivals, and citywides. Treat each as its own pricing and distribution plan with clear fences.

- Build three forecasts weekly. Base, stretch, downside. Tie each to a price posture, a paid-media posture, and a channel strategy. Publish the triggers that move you between them.

- Install guardrails for price testing. By day type and segment, set min/max fences and cadence. Let automation execute within those bands; review exceptions, not every movement.

- Rewrite rate names for humans. If a guest can’t tell the difference in under three seconds, you’ll leak demand. Pair each public rate with one clear value element that costs you less than it’s worth to the guest.

- Align marketing with revenue. Bid into event spikes; throttle or reshape spend on soft periods where wholesale or packages can do the heavy lifting more efficiently.

- Treat metasearch as RM. Monitor live parity, automate bid scaling at occupancy thresholds, and push mobile-preferred value to your direct site on compression nights.

- Shorten the mobile path to purchase. Fewer fields, faster payment, visible perks. Test the flow yourself on a slow network; fix what frustrates you.

- Clean your integrations before buying more tools. Map every data handoff between PMS, CRS, RMS, and your analytics. Count manual exports. Your first 10 hours of saved effort will beat your next shiny feature.

- Restructure the revenue meeting. Yesterday’s exceptions, this week’s moves, four-week outlook. Owners, deadlines, and a written decision log. Everything else async.

- Close the parity and cancellation gap. Weekly leakage audit, channel contracts with teeth, and pre-arrival messaging that invites a small upsell while reaffirming value.

Download PDF checklist here

Five Mini-Playbooks For Common Scenarios

High-demand event weekend: Open with higher floors earlier, enforce longer minimum stays, and funnel value to shoulders. Keep a last-room value-added direct offer live (parking or F&B credit) rather than cutting rates at the eleventh hour.Weekend leisure softness: Bundle experiences rather than discount. Ticketed micro-events (tasting, yoga, gallery) paired with late checkout often outperform raw price cuts.Weekday corporate rebuild: Target small-team and project travel. Offer flexible workspace add-ons and simplified direct billing; price for total stay value, not just ADR.Fickle group pace: Protect base with time-boxed options and meaningful deposits. When wash rises, release inventory via channel-limited fences first, not via broad public discounting.Weather volatility: If your market swings on weather, pre-load weather-triggered offers. Automate bid and price posture shifts tied to forecast thresholds.

Metrics That Matter (And How To Use Them)

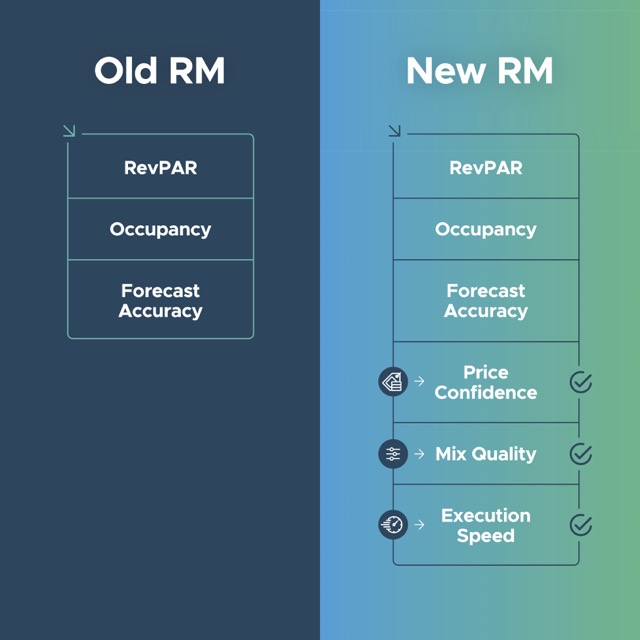

We heard a lot about KPIs. The standouts weren’t exotic; they were disciplined. Pace versus same-time-last-year is useful only when contextualized with event calendars and comp volatility. RevPAR remains the scoreboard, but RevPAG (revenue per available guest) and net revenue per available room sharpen decision-making by factoring channel costs and ancillary uptake. Forecast accuracy matters less as a vanity metric and more as a trigger discipline—what matters is how quickly you change posture when reality diverges. In our practice, we monitor three “quality of revenue” gauges: price confidence (how often we lead vs. follow our comp), mix quality (share of high-contribution channels and segments), and execution speed (time from signal to decision to deployment). Improve those three and the classic KPIs tend to follow.

How To Socialize Change Without Burning Your Team Out

Change fatigue is real. What works, in our experience and in respondents’ comments, is narrating the “why” and limiting concurrent experiments. Pick two levers per month. Celebrate the learning, not just the win. When we introduced scenario planning with a client team, we didn’t ask for perfection; we asked for a weekly rhythm and a visible trigger board. Two months later, pricing conversations were calmer, and results were better because everyone could see the game they were playing.

The Bottom Line

This market rewards pace and punishes drift. The properties that will win are not necessarily the flashiest or the most discounted—but the ones that learn the fastest, execute the cleanest, and align revenue, distribution, and digital around the same calendar and the same triggers. That’s how we operate, and it’s how we help partners operate too. If you adopt even a few of the practices above—micro-seasons, scenario forecasts, price-guardrail testing, and integration hygiene—you’ll feel the compounding effect in your RevPAR, your net revenue, and the calm inside your weekly revenue meeting. We’ll keep listening to hoteliers and building what makes their lives—and their numbers—better. If you want, share your event calendar and your top three constraints; we’ll map a first micro-season plan together and get you moving fast.